Menu

In 2018, the Tax Reform for Acceleration and Inclusion (TRAIN) Law took effect. Although a lot of changes were made, it still didn't change the fact that freelancers (like myself) are required to pay taxes.

So that's why I decided to finally register as a self-employed individual in the Bureau of Internal Revenue (BIR) this year. Freelancers (whether doing online or offline work) are categorized as professional and self-employed individuals by the BIR.

Also I'm registering because if ever an international client is planning to fly me to countries where Filipinos are required to obtain visas, I'd have a legal tax document to present for my visa application.

In this article, I detailed my personal experience following the simplest method in registering as a freelancer/self-employed individual in BIR. I hope that being specific down to the last detail will encourage other members of the freelancing community to do the same and contribute to the growth of our economy.

Before I get down to the nitty-gritty details, I have some disclaimers for those who are reading this:

Okay. Now we're done with those, take a look at the Registration requirements below. It's fine if you don't understand all of them because I'll be explaining each.

For your BIR Certificate of Registration (COR), you will need the following:

For your BIR Official Receipts (OR), you will need the following:

Before going through the Registration Proper, make sure you have or have done the following:

This is the #1 requirement. Normally you get your TIN from your first company employer. They apply a TIN for you. In my case, I already had a TIN from my first call center company.

If you don't have a TIN yet, the BIR has made it available online to get a TIN and you can follow the instructions in this blog resource.

If you're a freelancer working from home, then you have to make sure that your TIN is in the correct RDO that covers your home address area.

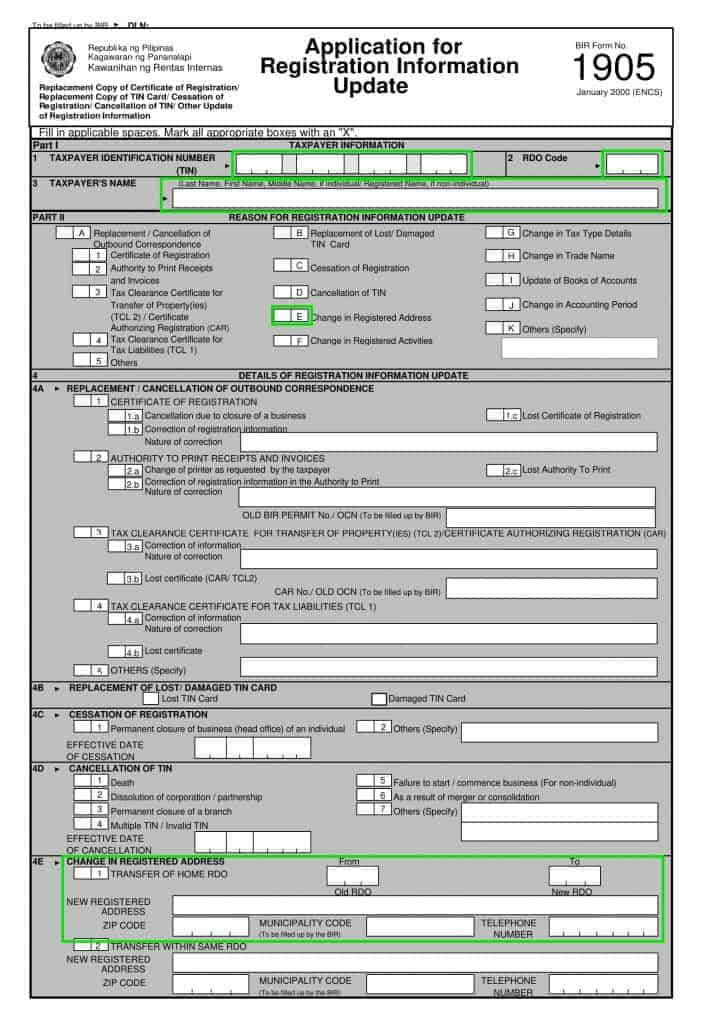

If your TIN is currently not in the correct RDO, then you have to request an RDO Change in BIR.

Since I moved back to Davao in 2016 and have not been employed in a traditional/corporate setting in Davao City, my BIR RDO is still in Taguig because that was where my last call center company was located.

I had to change my RDO to the BIR Davao office because I currently live in Davao now and I want to register as a self-employed professional in Davao City.

Method 1 - Go to the BIR Davao office, fill out a 1905 form and request them to fax it to the BIR Taguig office for processing.

Method 2 - Fly to Manila and personally go to the BIR Taguig office to request it from there. (That will take a lot of time and money)

After thinking about it at the time, I was going to Manila anyway to attend the VA Bootcamp Christmas Party 2018 so why not process my RDO change there.

So I went to the BIR Taguig office, submitted the 1905 form, the officer checked my details and then processed my request. He said it should be completed in 5 days.

I called the BIR Davao office a week after and yes indeed, my RDO has been changed.

For Example: If I was still living in Taguig City after I left my call center job, became a full-time freelancer, and I wanted to register as a self-employed professional in Taguig City, then there's no need to change my RDO anymore since it's the same area.

Time it took for this process:

If you don't have an original one with you, you can go to the nearest Philippine Statistics Authority (PSA) office and request for it or order it online. Here's a blog resource on how to order it online.

Make sure you have a photocopy of your Birth Certificate. The BIR will not get the original copy.

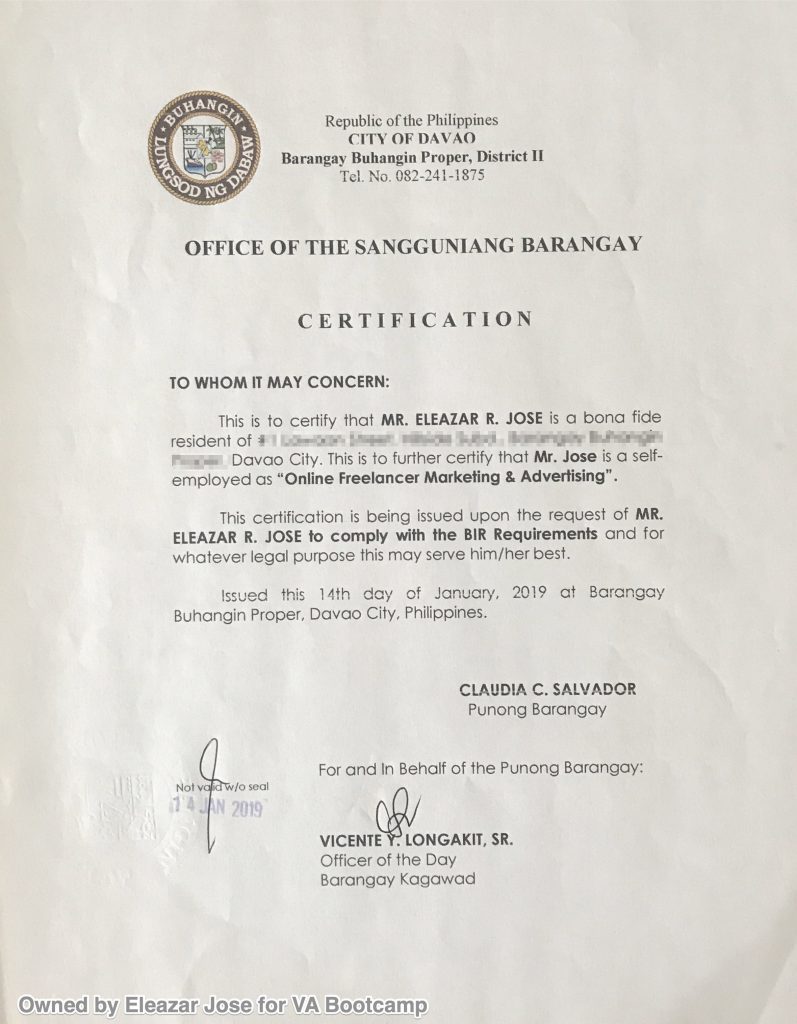

You will need to get a Barangay Certificate (not Clearance) clearly stating that you are working as an online freelancer.

Go to the Barangay office that covers your area of residence and

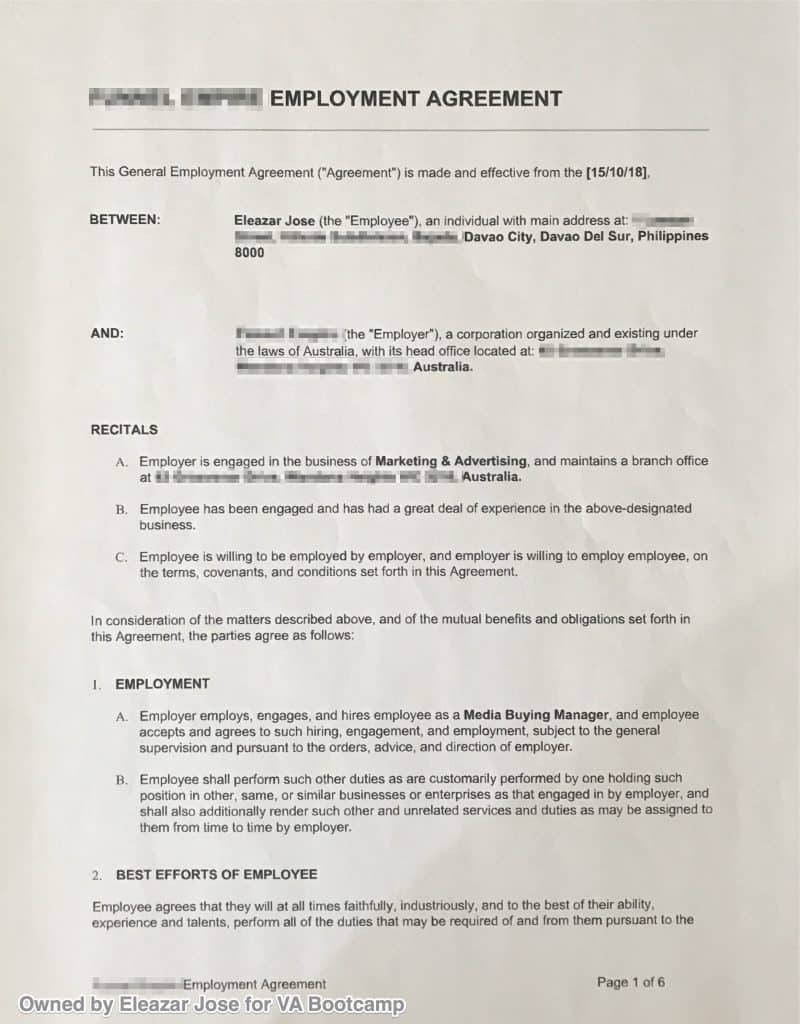

Then, ask it from your client. Whether your client is from Upwork (or other freelancing platforms) or is a direct client, ask them to provide you a

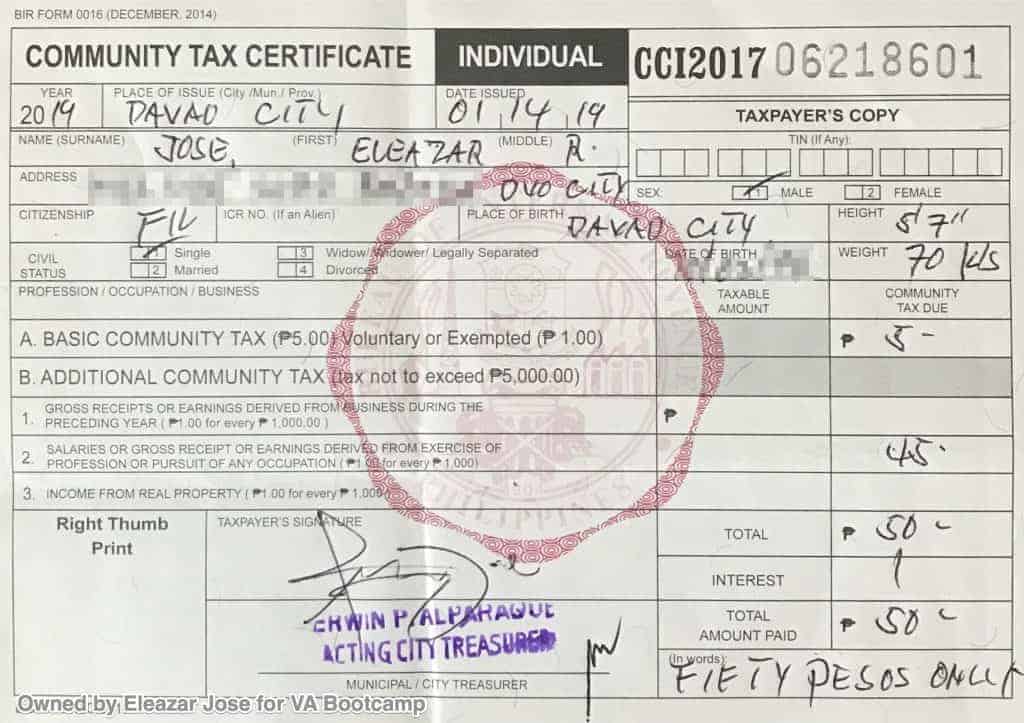

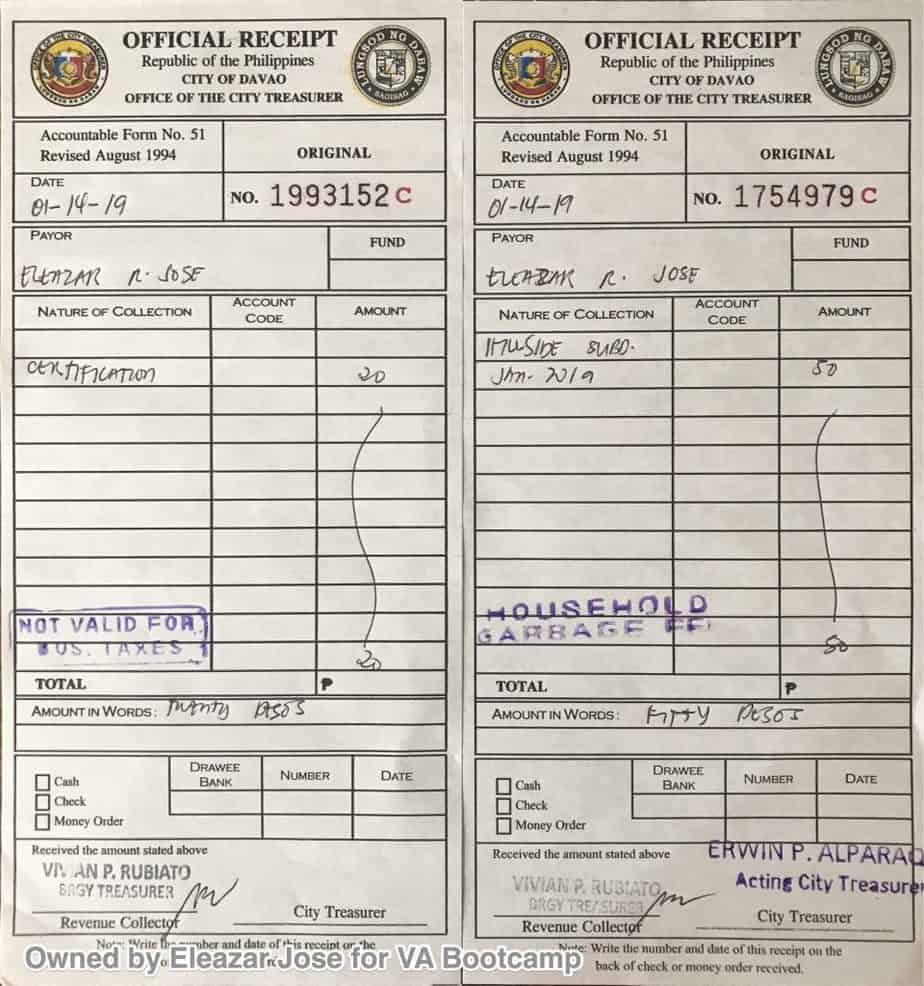

When I arrived at the Barangay office, I proceeded to get a Cedula first (50 pesos) and then went to the Barangay Secretary to request for the Barangay Certificate. I specifically mentioned that I needed it to register as a self-employed professional in BIR and I need the Certificate to say that I am working as an online freelancer. Gave her these very specific instructions to follow because I did not want to go back there in any case that the BIR will not accept their templated Certificate.

She created and printed my Barangay Certificate, put on the dry seal and told me I had to pay 20 pesos for the certification and 50 pesos for the household garbage fee. Gave her the payment and she issued the receipts. Photocopy the Barangay Certificate because BIR will need it.

After getting my Barangay Certificate, I went to the BIR office. There are 2 BIR RDOs in Davao City so I had to make sure that I was registering in the RDO that covered my residence address.

You can check this BIR directory to see which is the RDO covering your area. The RDOs addresses and contact numbers are listed there.

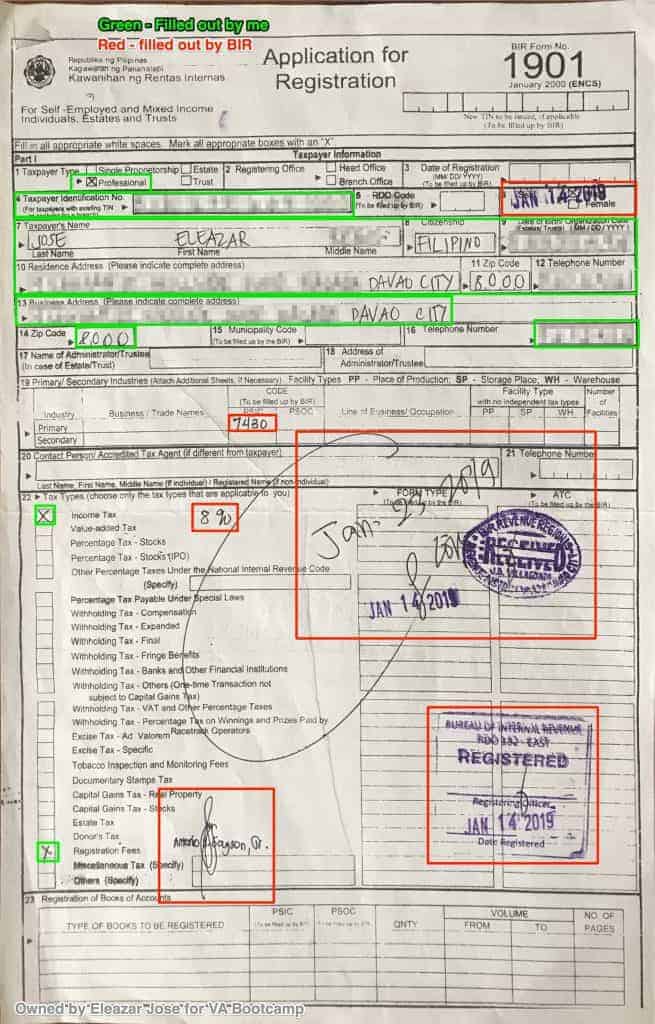

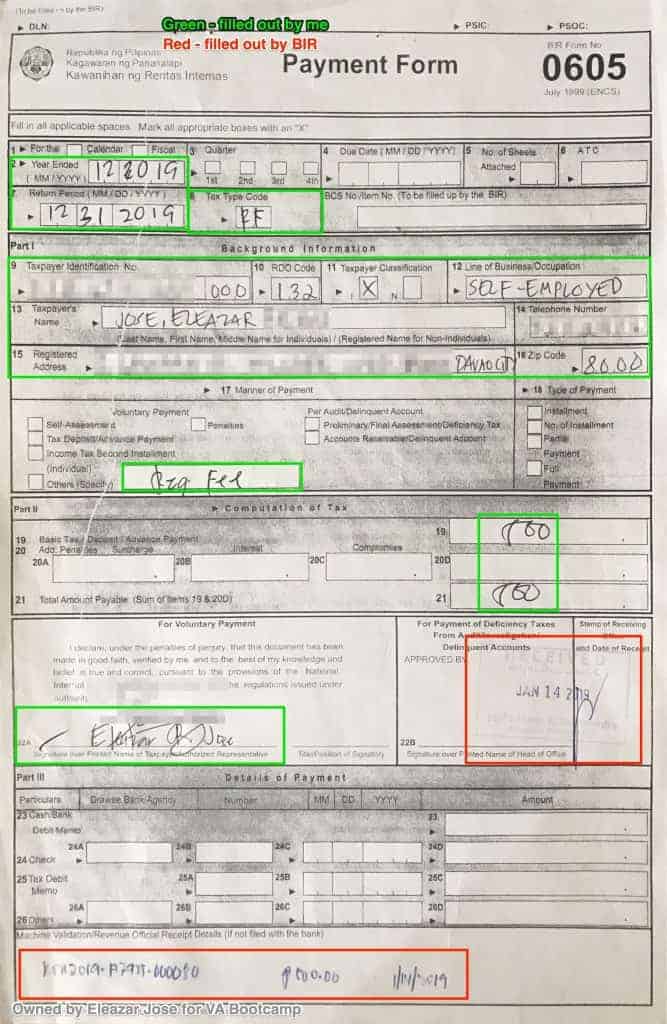

When I arrived at the BIR office, I got 3 copies each of forms 1901 and 0605, filled them out and got a queue number from the guard at the entrance door of the office.

When my queue number was called, I approached the assessing officer and told her I was registering as self-employed.

She asked some questions so she can complete the forms I submitted. Like “What kind of business?”

I said, “I work online as a freelancer and I work from home”

She asked, “What kind of work?”

I said, “Online marketing and advertising, Facebook marketing, Online campaigns, digital marketing”. I rambled some general terms so she can easily understand me. And she did.

She was looking at her computer and researching for that kind of work. I guess she found what she was looking for and wrote a code on my form. This I figured was the work classification.

She proceeded to select the type of Taxes applicable to me. I also informed her that I’m opting in for the 8% tax thing by the new law of the government.

She noted that in my form and checked my other requirements.

After everything was checked, she endorsed me to another officer assigned to process new business registrations.

When it was my turn, she double checked my requirements and the three (3) 1901 forms. Everything was complete. She then told me to fill out the 0605 forms for the payment and told me where I could pay. Landbank and DBP.

I told her I didn’t want to go there and she mentioned that I can also pay there but their cashier won’t be in for another hour.

Well it was gonna take me an hour or so as well to go to the banks suggested and wait (because the lines are long at these government banks). I chose to stay there in the BIR office and wait for the Cashier.

When the Cashier arrived, I gave the officer of the new business registrations section my 1901 forms (3 copies), 0605 forms (3 copies), Barangay Certificate (one photocopy) and 500 pesos payment.

My documents and payment were handed to their backend officers who encoded my details and the cashier processed my payment.

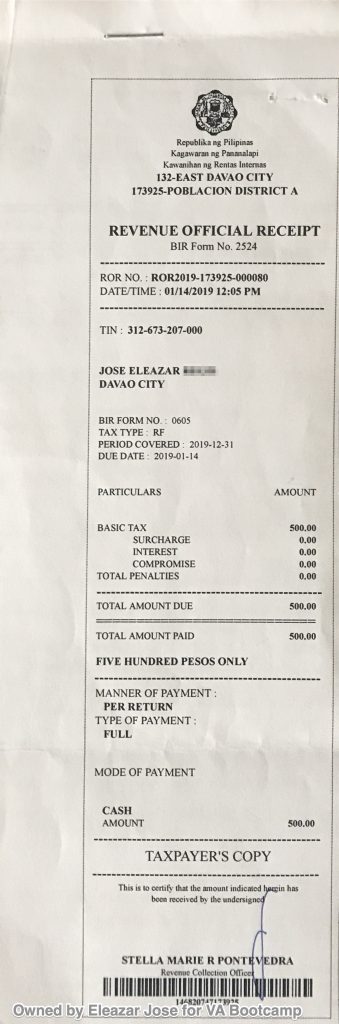

I guess it was another 15-20 minutes before they called my name and handed me back my documents.

They gave me back the following documents:

My 1901 form was finally RECEIVED and I was finally REGISTERED! I was told to come back the next day to get my Certificate of Registration (COR) document.

Even though I could have come back the next day to claim my COR, I came back the week after and brought with me the following:

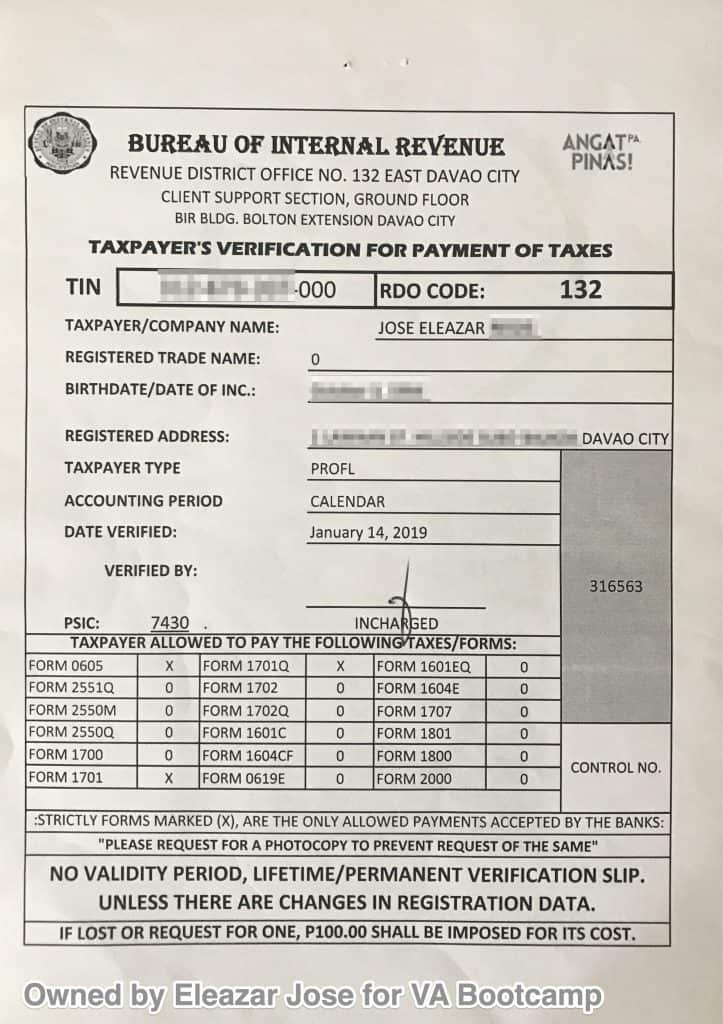

When my queue number was called, I informed the officer that I'll be getting my COR and then gave my 1901 and 0605 forms.

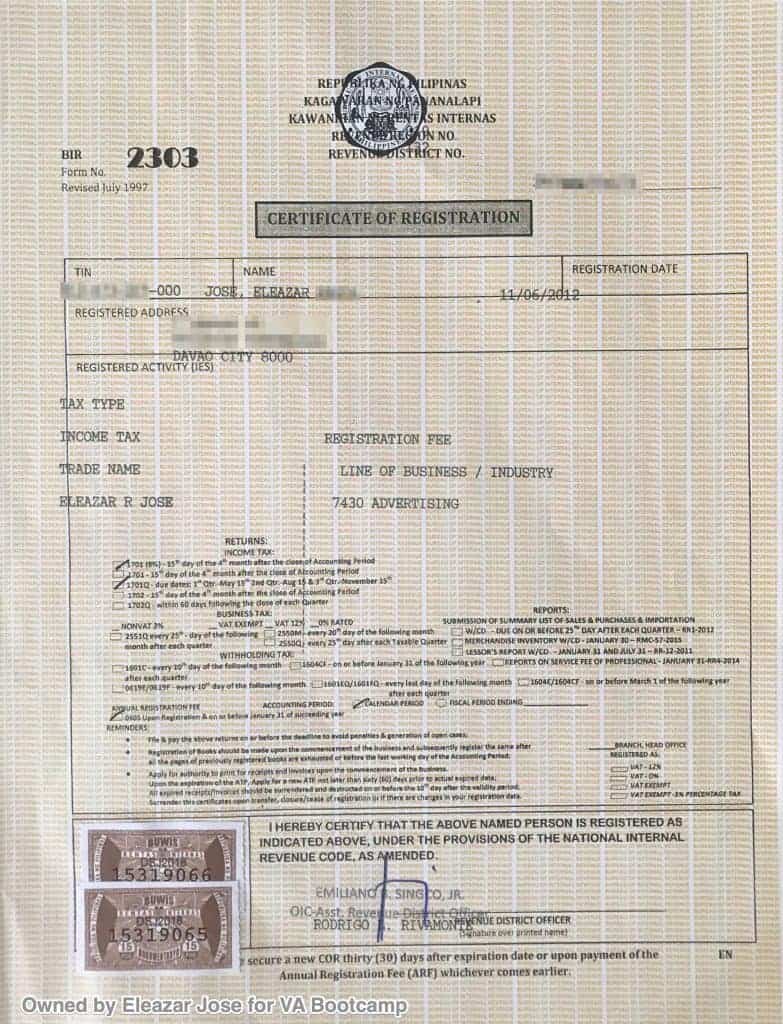

After a while, the officer called my name, handed my COR and had me sign the ledger confirming that I received my COR.

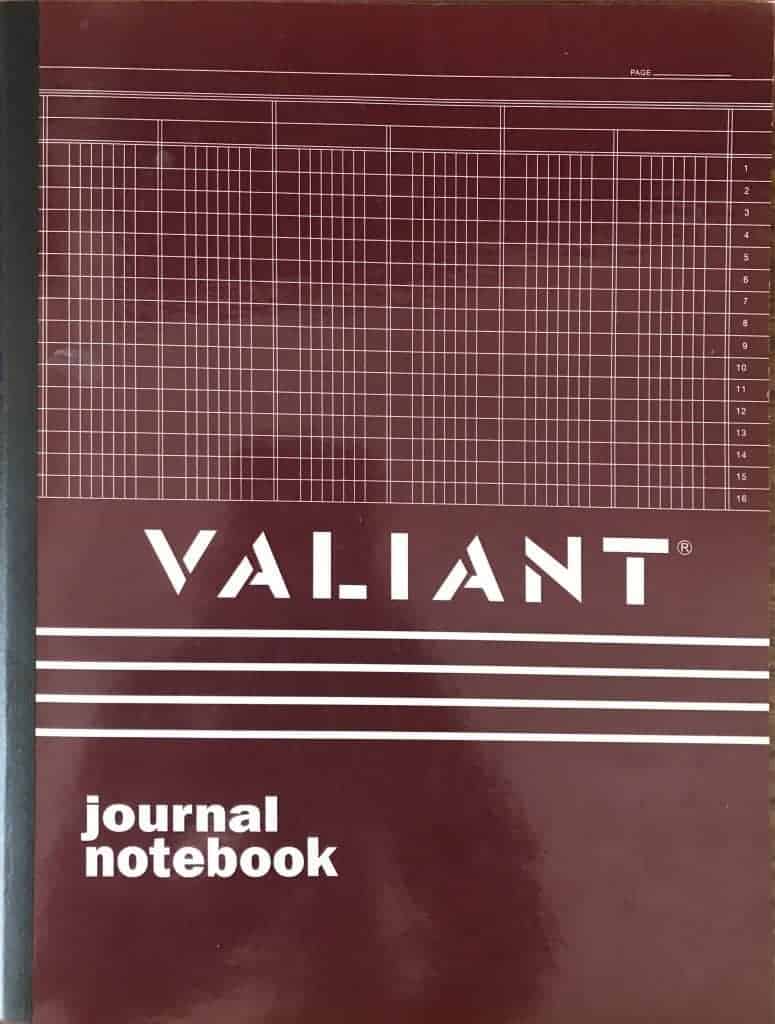

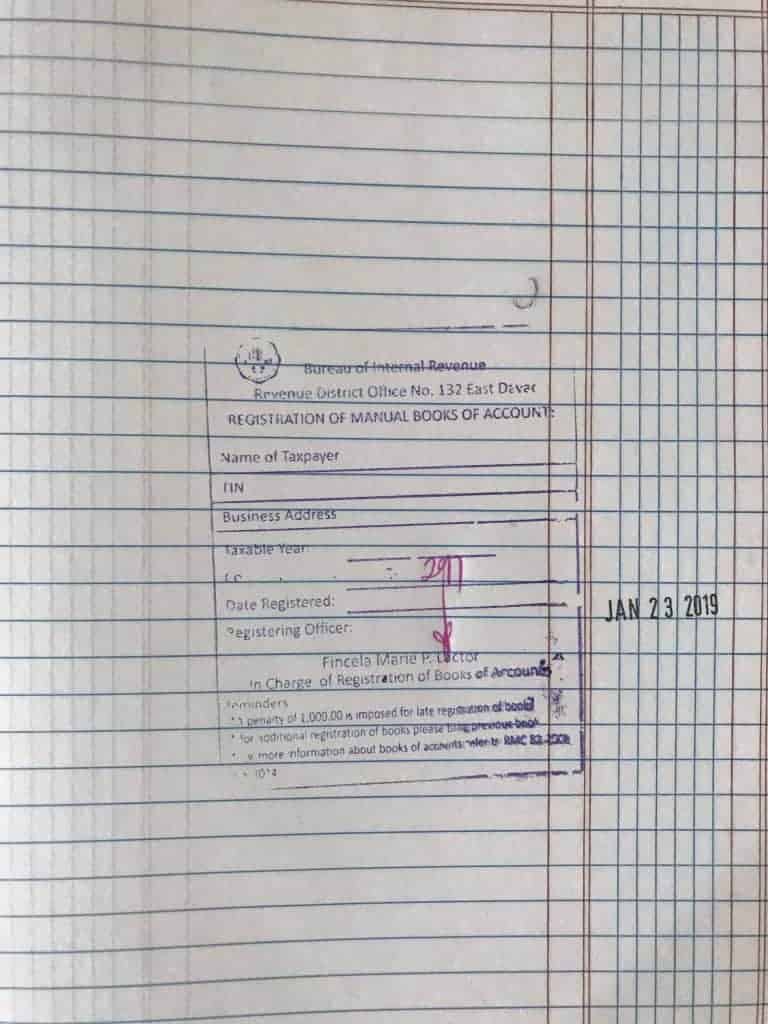

Then I went to the officer in charge of stamping Journals. Showed the officer my 1901 form and then my Journal was stamped on the first page.

I signed on the officer's ledger to confirm that my Journal was already stamped by the BIR.

Under the current government administration, attending the BIR Seminar is voluntary and is not required. That's what the BIR officer who conducted the seminar said.

I attended the seminar because I had a lot of questions to ask. Questions that were specific to me as a work from home online freelancer.

One of the things I focused on was calculating the tax dues. To make things simpler, I opted in to the 8% Income Tax Rate on Gross Sales/Receipts.

This simply means that whatever I earn from my client/s, I only pay 8% income tax. No more percentage tax, no more deductions of operational expenses, etc.

I'll be discussing how the 8% income tax rate option works and document the filing process in upcoming blog posts since it's my first time that I'll be doing those as well so stay tuned for those.

For now, all you need to know is I chose the 8% option because it's the best for my freelancing business.

Since the Taxpayer's Seminar was voluntary, there wasn't any Certificate of Attendance to be given out but the BIR officer who conducted the seminar signed on my 1901 form that I attended because I told him I wanted proof in case I needed it in the future.

As an online freelancer who just registered as a self-employed individual in the BIR, I am required to issue an Official Receipt for my client earnings. Meaning I will have to give receipts to my clients whether local or international.

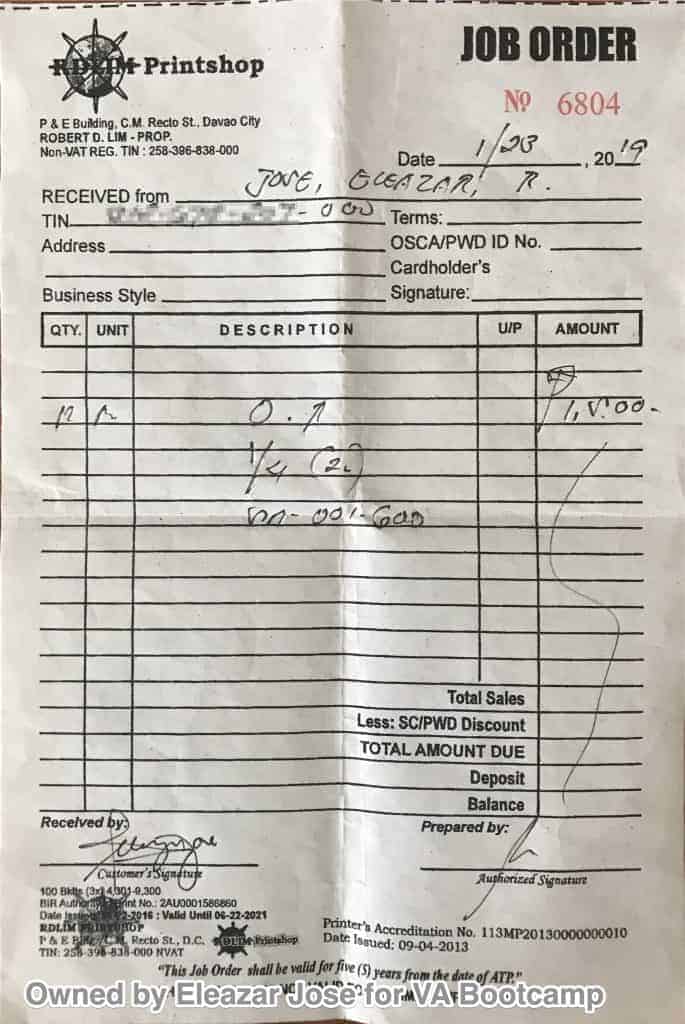

Before I actually do this, I need to have an official receipt printed by a BIR-accredited printing press facility.

Your BIR RDO office should have a list of their accredited printing press facilities. They are separate companies from the BIR because the BIR does not print receipts for businesses.

In my case, while I was asking for the accredited printing press list in the Forms Section of the BIR office, an employee told me that one of the accredited printing press' representatives was there.

I really did not want to go through a fixer or be scammed at this point but the representative was legit as I asked for his ID.

I gave him my docs (COR, Barangay Certificate, TIN ID, 0605 form and payment receipt) and he photocopied all of them.

I signed on the relevant docs including the Authority to Print form and paid him 1,500. He issued me a receipt and said that it will take 2 weeks for my receipt booklets to be printed.

Gave me instructions and directions to the location of their printing press where I will be claiming the receipt booklets after 2 weeks.

I also got the rep's contact info via his calling card.

Expectation was I'd get the receipt booklets 2 weeks from the date I ordered them. In reality, it took almost 3 weeks because they still had to get the Authority To Print (ATP) form and Booklet #1 stamped as Received by the BIR.

I finally got my Official Receipt (all 12 booklets) on February 12, 2019.

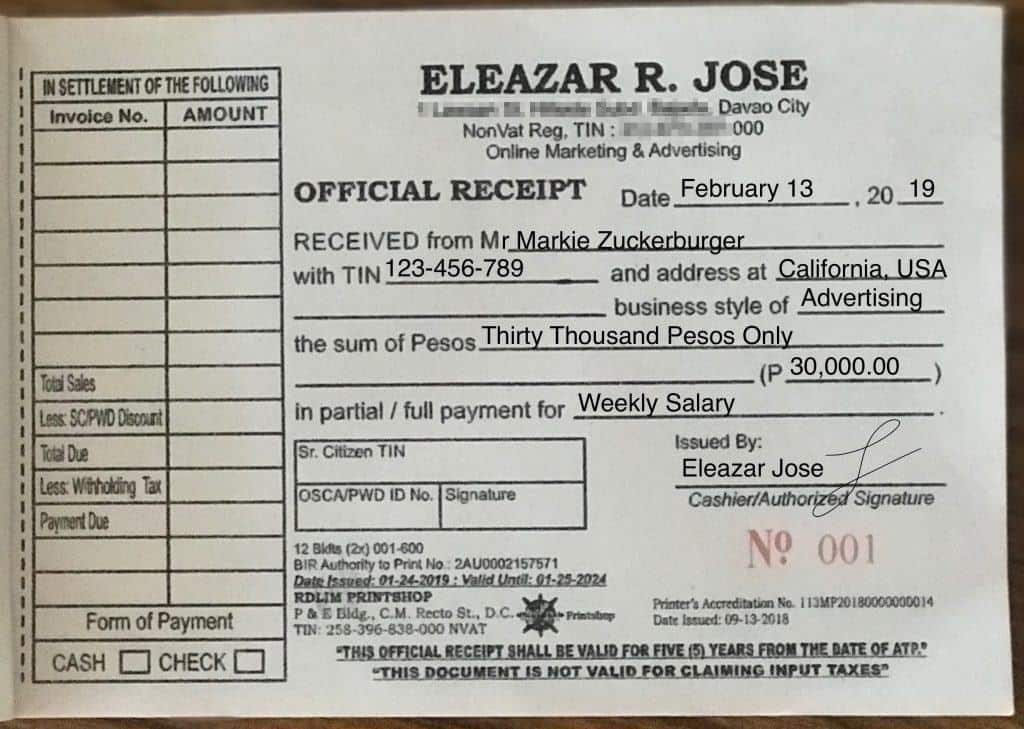

How to issue an official receipt to an international client? All you need are their name and Tax Identification Number (or whatever they call it) in their country, their address, business style, amount and payment description.

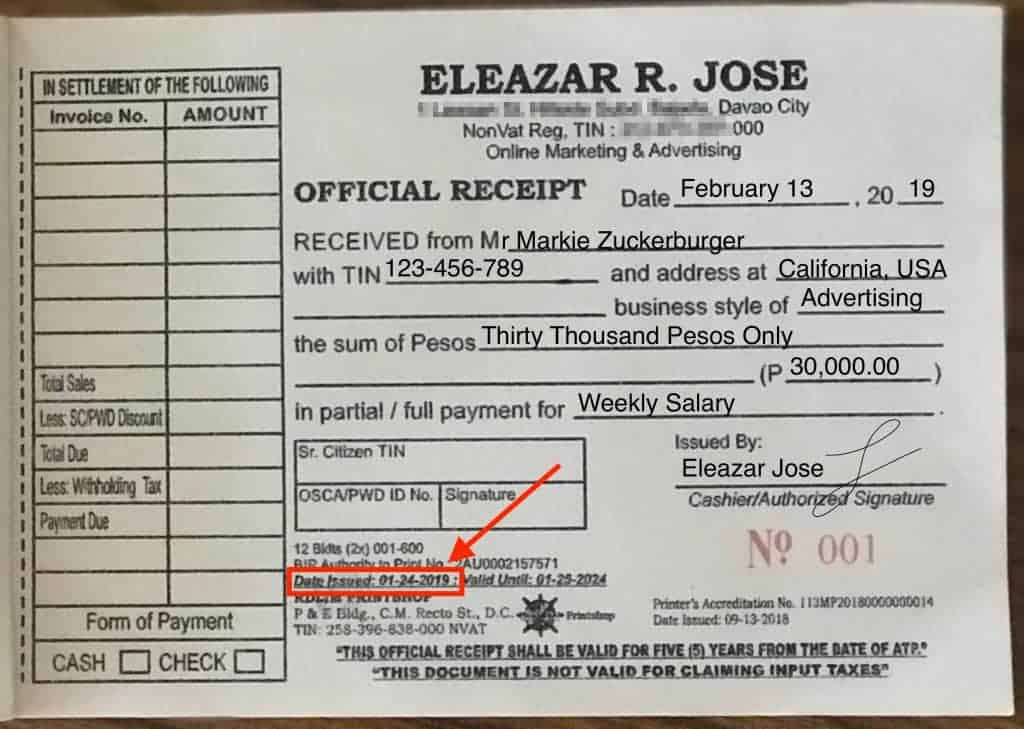

The start date on issuing receipts to clients will be the date your Authority to Print was approved. It's located on your receipt.

On my receipt, it's located here.

Example: My client paid me on January 23 however my date of ATP was January 24, I can only issue receipts on or after January 24.

The payments my client made before January 24 will not have a receipt.

If you do issue a receipt before the date of ATP, the BIR will question you when they find out and you will have an open case with them. You don't want that to happen because you'll have extra visits to the BIR office than you normally should.

I'm finally a registered taxpayer and I have my Official Receipts.

There are still a few things to take care of though like:

For these, I'll be documenting my processes every step of the way this year to benefit the members of the freelancing industry especially my fellow Davao freelancers so stay tuned for my upcoming blog posts.

If you have any questions, feel free to type them in the comments below. I'll do my best to help.

I'd also like to thank Grace Viray of whatevergracemeans.com for helping me understand the BIR Registration process we have in Davao City and also thanking our co-founder Holly Ocaya for writing the first blog post we have on the BIR Tax Registration process and for changing my tax beliefs.

As a freelancer who has gone through the BIR Registration process myself, I highly encourage everyone to register as well and legitimize your freelancing business. In time, you will reap what you sow (e.g. Income Tax Return).

And if you're not a freelancer yet but you really want to work from home, you can sign up first to our free introductory course at vabootcamp.ph/free

Hi Sir!

Thank you for posting this. I’ve been looking for a blog like this for a long time. I started freelancing a year ago after I left my company of 5 years. Do you know if BIR will give penalties for the months I wasn’t able to pay taxes? I haven’t paid my taxes since I left my company and haven’t updated my status as a self employed. Thanks in advance!

You're welcome Pao. I think, no they won't because you weren't registered with them as self-employed. You will only be penalized if you already registered as self-employed/professional but didn't file the correct reports (like monthly, quarterly etc.)

As I'm not a tax expert or accountant, please consult with one first as well regarding this matter. Thank you. 🙂

If I may add, if you start the registration process and been given the COR and Authority to Print but do not present the receipts 30 days after, you will be heavily penalized (10k to 25k depending on the RDO and how long it took you to present the invoice).

Thanks for the additional info Alvin! Duly noted and I'll add that in the blog post. 🙂

Thank you for your Blog. It's really a BIG HELP! Looking forward to your next Blog.

You're welcome Jo! Glad you found it helpful. 🙂

Sir maraming salamat po sa info pero may tanong lang po ako. I cannot produce a contract from my clients kasi po fixed price lahat ng work ko sa Upwork and currently wala po akong client. Paano po kaya yun? Sa example nyo po parang on-going kayo sa current client nyo. Ano po kayang pwedeng ma suggest ninyo?

Maraming salamat po!

Welcome po. Gawa gawa ka na lng ng contract mo and make it look professional. Ikaw na din magsign and such. Di naman chineck yung akin basta meron lang silang makita and ma keep for their records. Please check pa din sa BIR RDO mo regarding their specific requirements ha kasi baka iba pla need nila.

In the event I opted to use my registered business name from DTI, can it be done?

Yes that can be done. But you'll be registering in the BIR as a business, not as an individual/professional like what I outlined in this blog post. You can check other blog posts that specifically documented/tackled that situation.

Hi po.

Pwede po malaman kung anong itsura ng stamped receipt ng bir? Kasi po yung sa akin ay hindi ko sigurado kung meron na ba sya. May nabasa po kasi ako na kailangan stamped received ni BIR, at dapat may ibibigay na kopya sakin ng ATP at PCD (na wala pong binigay sakin). Meron din po ba kayong ATP at PCD na stamped din ni BIR? thank you

Hi Lucky, please message me on my FB Page https://m.me/eleazarrjose and I'll send you a pic of the BIR stamp at the back of my receipt booklet. All my docs regarding receipt, the booklets, the ATP have been stamped by BIR and they were all handled by the printing press I chose. I don't know what PCD is.

Hi sir. Nagmessage na po ako sa inyo. Thank you very much po

Thanks for the info! Very helpful!

You're very welcome 🙂

Hi po! ask ko lng, I registered my TIN online under self employed last 2014 pa and I didn't process it means di ako nkabayad ng 500 since. Pano po yun? Di pa nmn registered talaga diba? or babayaran ko ang annual na 500 till this year if mg proprocess na ako now? Thanks po medyo malabo concerns ko..

Hello Amor, best advice I can give is for you to approach your BIR RDO to get the complete info on what to do. From what I know, getting a TIN is free and if you didn't pay the annual 500 pesos registration fee as self-employed declaration in BIR back in 2014, then you can go ahead and process it now. The payment of your 500 pesos annual registration fee now will be good until end of the year. Come next year, you will have to pay again and every year after that for renewal, still 500 pesos per year.

Please do check with a Certified Public Accountant or Bookkeeper or directly at your BIR RDO for complete info regarding your situation. Thank you.

Very informative sir LJ... thank you so much. This was I was asking about during our Nooice Orientation at Gensan last June 22 po 🙂

You're welcome Gina!

Question po, kung nag file ka for freelancing, tapos nainip ka sa bahay at nag decide ka mag work na lang sa office ulit - pano mo maiwasan na mapenalty sa freelancing tax?

In case na unmployed ka - nag quit ka doing homebase and di ka muna nag work - pano po?

I suggest you don't register first as a freelancer or self-employed when you're just starting and then consider filing for necessary taxes when income becomes stable. That way you have enough time to decide if you'll continue freelancing or go back to the corporate.

Such detail! Looking forward sa article ng pag-record sa journal. 🙂

I like it when individuals come together and share thoughts.

Great blog, continue the good work!

My site - 성남교정치과

I have been browsing online more than 3 hours today, yet I never found any interesting article like yours.

It is pretty worth enough for me. In my opinion, if all website owners and

bloggers made good content as you did, the web will be a

lot more useful than ever before.

What's up to every one, it's in fact a good for me to pay a quick visit this

site, it consists of useful Information.

Excellent, what a blog it is! This web site

gives useful facts to us, keep it up.

Hi admin. Thank u very nice web site. Artichle too nice. 🙂

Exceptional post however I was wanting to know if you could write a litte

more on this topic? I'd be very grateful if you could elaborate a

little bit further. Bless you!

Thanks for another informative web site. The

place else may just I get that type of info written in such a perfect

approach? I've a challenge that I'm simply now running on, and I've

been at the glance out for such info.

If you wish for to increase your knowledge simply keep visiting this web site and

be updated with the most recent information posted here.

Ahaa, its nice conversation regarding this article here

at this blog, I have read all that, so now me also commenting here.

Quality articles or reviews is the secret to interest the

viewers to visit the website, that's what this website is providing.

Hello guys. Very nice web site admin. Thank you 🙂

I don't even know how I stopped up here, but I thought this post was once

great. I don't recognize who you're however certainly you're going to a well-known blogger should you aren't already.

Cheers!

What's up to all, how is all, I think every one is getting

more from this web page, and your views are fastidious for new visitors.

If you are going for most excellent contents like I do, just visit this site daily because it presents quality contents, thanks

Superb post however , I was wondering if you could write a litte more on this topic?

I'd be very thankful if you could elaborate a little bit further.

Cheers!

I'm not sure where you're getting your information, but

good topic. I needs to spend some time learning much more or understanding more.

Thanks for wonderful information I was looking for this info for my mission.

My blog post ... remote career opportunities

Hmm is anyone else having problems with the images on this

blog loading? I'm trying to figure out if its a problem on my end or if

it's the blog. Any feed-back would be greatly

appreciated.

Hello, i believe that i saw you visited my weblog so i got here to go back the prefer?.I am attempting to

in finding issues to enhance my web site!I guess its

good enough to make use of some of your ideas!!

Asking questions are actually pleasant thing if you are not understanding

anything entirely, however this paragraph presents fastidious understanding yet.

Thank you, I have recently been looking for info about this topic

for ages and yours is the greatest I have came upon till now.

However, what in regards to the conclusion?

Are you positive in regards to the source?

of course like your web-site however you need to take a look at the spelling on several of your posts.

A number of them are rife with spelling problems and

I to find it very bothersome to inform the truth then again I

will definitely come again again.

Howdy, I believe your blog might be having web browser compatibility problems.

Whenever I look at your site in Safari, it

looks fine however, when opening in IE, it has some overlapping issues.

I just wanted to give you a quick heads up! Besides that, fantastic website!

Everyone loves what you guys are up too. This sort

of clever work and reporting! Keep up the fantastic works guys I've added you guys to my own blogroll.

Hey There. I found your blog using msn. This is a really well written article.

I will be sure to bookmark it and come back to read more of your useful information. Thanks for the post.

I will certainly comeback.

Great blog you have here.. It's hard to find excellent writing

like yours these days. I really appreciate individuals like you!

Take care!!

Pretty! This has been an extremely wonderful article. Thanks for supplying this info.

Thanks for ones marvelous posting! I seriously enjoyed reading it, you are a great

author. I will be sure to bookmark your blog and will come back down the road.

I want to encourage that you continue your great posts, have

a nice evening!

Wow! This blog looks just like my old one! It's on a totally

different subject but it has pretty much the same layout and design. Excellent choice of

colors!

Thank you for the auspicious writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you!

By the way, how can we communicate?

You can go to this website for more useful freelancing tips: freevacourse.com

Good day! I could have sworn Iíve been to this blog before but after going through some of the articles I realized itís new to me. Anyways, Iím certainly happy I discovered it and Iíll be book-marking it and checking back often!

Hey would you mind sharing which blog platform you're using?

I'm planning to start my own blog soon but I'm having a

hard time making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs and I'm looking for something completely unique.

P.S Apologies for being off-topic but I had to ask!

You can go to this website for more useful freelancing tips: freevacourse.com

you are truly a good webmaster. The site loading velocity is amazing.

It sort of feels that you are doing any distinctive trick.

Also, The contents are masterwork. you have done a wonderful activity on this subject!

Hey I know this is off topic but I was wondering if you knew of any widgets I

could add to my blog that automatically tweet my newest twitter updates.

I've been looking for a plug-in like this for quite some

time and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy reading

your blog and I look forward to your new updates.

You can go to this website for more useful freelancing tips: freevacourse.com

I've been exploring for a little bit for any high quality articles

or weblog posts in this kind of area . Exploring in Yahoo I eventually stumbled upon this website.

Studying this info So i am happy to exhibit that I've a very

just right uncanny feeling I came upon exactly what I

needed. I such a lot undoubtedly will make certain to do not overlook this website and provides it a look regularly.

I've been surfing online more than three hours these days, yet I

never found any fascinating article like yours.

It is lovely value sufficient for me. In my view, if all web owners and bloggers made excellent content

as you did, the web will be much more helpful than ever before.

Hey very cool site!! Man .. Excellent .. Amazing .. I'll bookmark your website and take the feeds additionally?

I'm glad to find numerous helpful information right here in the put up, we

need work out more strategies on this regard, thanks for sharing.

. . . . .

I visited multiple web sites however the audio quality for audio songs present at this

website is in fact excellent.

I'm really enjoying the design and layout of your blog. It's a very

easy on the eyes which makes it much more pleasant for me to come here

and visit more often. Did you hire out a developer to create your theme?

Excellent work!

I'll right away grasp your rss as I can not find your email subscription link or newsletter service.

Do you've any? Please permit me recognize so that I may subscribe.

Thanks.

You can go to this website for more useful freelancing tips: freevacourse.com

Greetings! I know this is somewhat off topic but I was wondering which blog platform are you using for

this site? I'm getting sick and tired of WordPress because I've had problems with hackers and

I'm looking at options for another platform. I would be

great if you could point me in the direction of a good platform.

You can go to this website for more useful freelancing tips: freevacourse.com

What's up to every , as I am actually keen of reading this blog's post to be updated

daily. It contains fastidious information.

It's genuinely very difficult in this active life to listen news on Television, thus I just use the web for

that reason, and get the most up-to-date information.

This website was... how do you say it? Relevant!! Finally I have found something that helped me.

Thanks a lot!

Excellent beat ! I would like to apprentice while you amend your web site, how

can i subscribe for a weblog site? The account aided me a acceptable deal.

I were a little bit familiar of this your broadcast

offered bright clear concept

Muchos Gracias for your blog.Much thanks again. Want more.

Hello mates, how is the whole thing, and what you desire to say regarding this article, in my view its really amazing in favor of me.

This info is worth everyone's attention. How can I find out more?

You can go to this website for more useful freelancing tips: freevacourse.com

Can you tell us more about this? I'd care to find

out some additional information.

You can go to this website for more useful freelancing tips: freevacourse.com

Do you have any video of that? I'd like to find out more details.

You can go to this website for more useful freelancing tips: freevacourse.com

Having read this I believed it was very informative.

I appreciate you taking the time and energy to put this short article together.

I once again find myself personally spending way too much time both reading and leaving comments.

But so what, it was still worth it!

I have been surfing on-line more than three hours nowadays,

but I by no means discovered any attention-grabbing article like yours.

It is lovely worth sufficient for me. Personally,

if all site owners and bloggers made just right content

material as you probably did, the web might be a lot more helpful than ever

before.

I'll right away grasp your rss feed as I can not to find your email subscription link or newsletter service.

Do you have any? Kindly let me recognise in order that I may

just subscribe. Thanks.

You can go to this website for more useful freelancing tips: freevacourse.com

Good article. I'm going through some of these issues as well..

Wow, this paragraph is good, my sister is analyzing these things,

thus I am going to convey her.

Hello to every body, it's my first pay a visit of this blog; this weblog contains awesome

and truly good information in favor of readers.

What's up everybody, here every one is sharing these

knowledge, therefore it's good to read this website, and I used to pay a quick visit this weblog all the time.

Good info. Lucky me I came across your blog by chance (stumbleupon).

I have book marked it for later!

Hello my friends. İts web site too like. Thank you admin:)

Hello my frends. İts web site too like. Thank you very nice admin:)

Appreciating the persistence you put into your

site and in depth information you present. It's great to come across a blog every once in a while that isn't the same out of date rehashed information.

Great read! I've bookmarked your site and I'm including your RSS feeds

to my Google account.

Pretty part of content. I just stumbled upon your website and in accession capital to assert that

I get in fact loved account your blog posts.

Anyway I'll be subscribing to your augment or even I fulfillment you get admission to persistently quickly.

I am in fact glad to glance at this blog posts which contains plenty of useful information, thanks for providing such data.

I think the admin of this web page is really working hard in support of his web page, since here every stuff is

quality based material.

Hey very nice blog!

Hello there! This article could not be written any better!

Looking at this article reminds me of my previous roommate!

He constantly kept preaching about this. I most certainly will send this article to him.

Pretty sure he will have a good read. Many thanks for sharing!

Hi there, the whole thing is going nicely here and ofcourse

every one is sharing information, that's truly good, keep up writing.

Hi my friend! I want to say that this article is amazing,

nice written and come with almost all important infos.

I would like to peer more posts like this .

Hi there, its good piece of writing regarding media print, we all be aware

of media is a great source of facts.

Nice answers in return of this issue with solid arguments

and telling everything regarding that.

That is very interesting, You are a very professional blogger.

I've joined your rss feed and sit up for in search of extra of your excellent post.

Also, I've shared your web site in my social networks

Hi there! This post couldn't be written any

better! Reading through this post reminds me of my good old room mate!

He always kept chatting about this. I will forward this page to him.

Pretty sure he will have a good read. Many thanks for sharing!

Very good info. Lucky me I discovered your website by chance (stumbleupon).

I've saved it for later!

My brother suggested I might like this blog. He was totally right.

This post actually made my day. You can not imagine simply how much time I

had spent for this information! Thanks!

Hello friends, fastidious piece of writing and pleasant urging commented at

this place, I am in fact enjoying by these.

Asking questions are in fact pleasant thing if you are not

understanding anything fully, except this piece of writing provides

pleasant understanding even.

Awesome things here. I'm very satisfied to see your article.

Thanks a lot and I am looking ahead to touch you. Will you kindly

drop me a e-mail?

You can go to this website for more useful freelancing tips: freevacourse.com

Someone essentially assist to make critically articles

I'd state. This is the first time I frequented your web page

and so far? I amazed with the research you made to make this particular submit amazing.

Excellent job!

Hi to every body, it's my first pay a quick visit of this webpage; this web site

consists of awesome and in fact good data designed for visitors.

Fantastic goods from you, man. I've understand your stuff previous to

and you are just extremely wonderful. I really like what you've acquired here,

really like what you are stating and the way in which you say it.

You make it enjoyable and you still care

for to keep it wise. I can not wait to read much more from you.

This is actually a great website.

This is a topic which is near to my heart...

Thank you! Exactly where are your contact details though?

You can go to this website for more useful freelancing tips: freevacourse.com

Hello to all, it's genuinely a good for me to pay a visit this

web page, it contains priceless Information.

whoah this blog is wonderful i like reading your posts.

Stay up the good work! You realize, lots of people are

searching round for this information, you can aid them greatly.

Somebody necessarily lend a hand to make critically articles

I would state. That is the first time I frequented your web

page and to this point? I surprised with the research you

made to create this actual put up extraordinary.

Great process!

I really like reading a post that will make people think.

Also, thank you for allowing for me to comment!

Hello, I enjoy reading all of your article post. I like to write a little comment to support you.

This is my first time go to see at here and i am in fact pleassant

to read all at one place.

If some one needs expert view regarding running a blog after

that i advise him/her to go to see this webpage, Keep up

the pleasant work.

My brother suggested I might like this blog. He was totally right.

This post truly made my day. You cann't imagine simply how

much time I had spent for this information! Thanks!

It is the best time to make some plans for

the future and it's time to be happy. I've read this post and if I could I want to suggest you some interesting things or advice.

Maybe you could write next articles referring to this article.

I desire to read even more things about it!

Excellent article! We will be linking to this great post on our

site. Keep up the good writing.

Thanks designed for sharing such a pleasant thought, post is

good, thats why i have read it fully

I'd like to find out more? I'd want to find out more details.

You can go to this website for more useful freelancing tips: freevacourse.com

I was recommended this blog by way of my cousin. I am now not positive whether this put up is written by him as no one else recognise such specified approximately my problem.

You're incredible! Thanks!

Your style is really unique in comparison to other

people I've read stuff from. I appreciate you for posting when you've got the opportunity, Guess I'll just bookmark this blog.

Thank you for the auspicious writeup. It if truth be

told used to be a leisure account it. Look complicated to more introduced agreeable from you!

By the way, how could we be in contact?

What's up friends, its impressive paragraph about tutoringand completely defined, keep it up all the time.

Excellent blog you have got here.. Itís hard to find high quality writing like yours these days. I really appreciate individuals like you! Take care!!

Hi, i think that i saw you visited my blog so i came to “return the favor”.I am trying

to find things to improve my website!I suppose its ok to use a few of your ideas!!

Heya! I just wanted to ask if you ever have any issues with hackers?

My last blog (wordpress) was hacked and I ended up losing a few months of hard

work due to no back up. Do you have any methods to protect against hackers?

Also visit my web page 온라인카지노

What's Happening i am new to this, I stumbled upon this I've found It positively helpful and it has aided me

out loads. I hope to contribute & aid other customers like its helped me.

Great job.

This is very fascinating, You're an overly skilled blogger.

I have joined your rss feed and sit up for in search

of more of your excellent post. Also, I have shared your site in my social networks

Just wish to say your article is as amazing. The clarity in your post is just nice and that i can think you are an expert in this subject.

Well together with your permission let me to seize your RSS feed to stay up to date with forthcoming post.

Thank you one million and please continue the rewarding work.

This design is steller! You obviously know how

to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost...HaHa!) Excellent job.

I really enjoyed what you had to say, and more than that, how you presented it.

Too cool!

I am actually happy to read this blog posts which carries tons of useful facts, thanks for providing these data.

Awesome! Its genuinely awesome paragraph, I have got much clear idea on the topic of from this piece of writing.

Hi would you mind stating which blog platform you're working with?

I'm looking to start my own blog soon but I'm having

a hard time choosing between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different

then most blogs and I'm looking for something completely unique.

P.S My apologies for getting off-topic but I had to ask!

my homepage; 온라인카지노

Some truly great information, Glad I detected this.

Quality articles or reviews is the key to attract the visitors to visit the web

page, that's what this site is providing.

I am sure this piece of writing has touched all the internet viewers, its

really really nice article on building up new web site.

Also visit my blog post 온라인카지노

bookmarked!!, I love your blog!

Excellent article! We will be linking to this particularly great

content on our website. Keep up the great writing.

You can definitely see your enthusiasm in the work you write.

The world hopes for even more passionate writers like you who are not

afraid to mention how they believe. Always go after your heart.

This paragraph presents clear idea for the new users of blogging,

that truly how to do running a blog.

Woah! I'm really enjoying the template/theme of this site.

It's simple, yet effective. A lot of times it's very hard

to get that "perfect balance" between usability and appearance.

I must say you have done a very good job with this.

Also, the blog loads very quick for me on Internet explorer.

Outstanding Blog!

Here is my blog: 온라인카지노

Greate post. Keep writing such kind of info on your site.

Im really impressed by it.

Hello there, You have performed a fantastic job. I'll definitely digg it

and in my view recommend to my friends. I am sure they will be benefited from this site.

What's up, I wish for to subscribe for this webpage to take most up-to-date updates, therefore where can i do it please help out.

my page: 온라인카지노

It's actually a cool and helpful piece of info. I am happy that

you simply shared this useful information with us.

Please keep us up to date like this. Thank you for sharing.

I do not know if it's just me or if everyone else experiencing issues with your website.

It seems like some of the written text in your content are running off the screen. Can someone else please

provide feedback and let me know if this is happening to them too?

This could be a problem with my internet browser because I've had this happen previously.

Cheers

if I had a choice of giving you two thumbs up definitely I would but so far

I'm more than happy to give you thumb up and thanks for your valuable

info

It's actually a great and useful piece of information. I'm glad

that you shared this helpful information with us. Please

stay us up to date like this. Thank you for sharing.

Hello there! Do you know if they make any plugins to help with Search Engine Optimization? I'm trying to get my blog

to rank for some targeted keywords but I'm not seeing very good success.

If you know of any please share. Cheers!

Your method of explaining the whole thing in this piece of writing is truly nice, all be capable of easily know it, Thanks a lot.

Awesome! Its in fact awesome post, I have got much clear idea regarding from this

post.

Nice post. I learn something new and challenging on blogs I stumbleupon every day.

It will always be exciting to read through content from other authors and practice a little something

from other sites.

I want to to thank you for this wonderful read!!

I definitely enjoyed every bit of it. I have got you book marked to look at new things you

post…

I am sure this post has touched all the internet people, its really really good paragraph on building up new

weblog.

Hello there, just became aware of your blog through

Google, and found that it's really informative. I am gonna watch out for brussels.

I'll appreciate if you continue this in future. Numerous people

will be benefited from your writing. Cheers!

Also visit my site :: 카지노사이트

I want to to thank you for this great read!!

I definitely enjoyed every bit of it. I have got you book marked to check out new stuff you

post…

After going over a few of the blog posts on your web page, I seriously appreciate your technique of blogging. I saved it to my bookmark website list and will be checking back in the near future. Please visit my web site as well and let me know what you think.

What's up to every one, the contents present at this web site are truly

awesome for people experience, well, keep up the good work fellows.

An outstanding share! I have just forwarded this onto a coworker who has been conducting a little homework on this.

And he actually ordered me dinner simply because I found it

for him... lol. So let me reword this.... Thanks for the meal!!

But yeah, thanx for spending time to discuss this matter here on your web

page.

There is definately a lot to find out about this issue. I like all the points you've made.

Heya are using WordPress for your blog platform? I'm new to the blog world but I'm trying to get started and create my own. Do you need any coding knowledge to make your own blog?

Any help would be really appreciated!

I feel this is one of the most vital info for me. And i am glad studying your article.

However should remark on few common issues, The web site taste is ideal, the articles is really nice

: D. Just right job, cheers

Tremendous things here. I'm very glad to see your article.

Thank you a lot and I'm taking a look ahead to touch you.

Will you please drop me a mail?

Hi, I do believe this is an excellent web site. I stumbledupon it ;

) I'm going to revisit yet again since I bookmarked it.

Money and freedom is the greatest way to change, may you be rich and continue to guide

other people.

After I originally commented I appear to have clicked on the -Notify me when new

comments are added- checkbox and now whenever a comment is added I recieve four emails with the exact same

comment. There has to be a way you are able to remove me from that

service? Kudos!

Thank you for some other great article. Where else could anybody get that kind of information in such an ideal way of writing?

I have a presentation subsequent week, and I'm on the look for such information.

Everything is very open with a very clear explanation of the issues. It was really informative. Your website is useful. Many thanks for sharing!

This paragraph gives clear idea designed for the new users of blogging, that

in fact how to do blogging and site-building.

An impressive share! I have just forwarded this onto a friend who had been conducting a little homework on this.

And he in fact bought me dinner because I stumbled upon it for

him... lol. So let me reword this.... Thank YOU for the meal!!

But yeah, thanks for spending some time to discuss this topic here on your site.

Hi there! I know this is kinda off topic but I was wondering if you knew where I could locate a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having difficulty finding one?Thanks a lot!

This blog was... how do you say it? Relevant!! Finally I have found something that helped me. Thanks!

This piece of writing gives clear idea designed for the

new viewers of blogging, that really how to do blogging and site-building.

Great article! This is the type of info that are meant

to be shared across the net. Shame on the search engines for

not positioning this put up higher! Come on over and visit my website .

Thanks =)

hello!,I love your writing so so much! proportion we keep in touch extra about your article on AOL?

I need an expert on this space to unravel my problem.

May be that is you! Taking a look forward to

see you.

Thanks for sharing your info. I truly appreciate your efforts and I will be waiting for your further write ups thank you once again.

Fantastic beat ! I wish to apprentice whilst you amend your site, how could i subscribe for a weblog

website? The account aided me a appropriate deal. I were

tiny bit acquainted of this your broadcast provided vivid transparent concept

The Information and Knowledge you are sharing is

like a drug, I can't seem to get enough.....

Great beat ! I would like to apprentice at the same time as you amend your web site, how can i subscribe for a weblog website?

The account aided me a acceptable deal. I have been a little bit familiar of this your broadcast offered brilliant transparent concept

I'm really loving the theme/design of your site. Do you

ever run into any web browser compatibility issues?

A handful of my blog readers have complained about my blog

not working correctly in Explorer but looks great in Firefox.

Do you have any advice to help fix this issue?

Here is my site: 카지노사이트

I am extremely inspired together with your writing abilities and also with the format

on your weblog. Is this a paid theme or did you customize it

your self? Anyway stay up the excellent quality writing, it's uncommon to peer

a nice blog like this one today..

I was curious if you ever considered changing the structure of your blog?

Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect

with it better. Youve got an awful lot of text for only

having 1 or two images. Maybe you could space it out better?

I just couldn't go away your website prior to suggesting that I extremely loved

the standard info an individual supply in your guests? Is gonna be back regularly to check out new posts

Excellent post. I was checking continuously this

blog and I am impressed! Extremely useful information specifically

the last part 🙂 I care for such info much. I was seeking this

certain information for a long time. Thank you and best of luck.

Howdy! This article could not be written much better! Looking through this

article reminds me of my previous roommate! He always kept preaching about this.

I am going to forward this information to him. Fairly certain he'll have a very good read.

Thank you for sharing!

my homepage; 카지노사이트

I know this if off topic but I'm looking into starting my own blog and was curious what all is required to get set up?

I'm assuming having a blog like yours would cost a pretty penny?

I'm not very web smart so I'm not 100% certain. Any recommendations or advice would be greatly appreciated.

Appreciate it

I am sure this post has touched all the internet viewers, its really really good article on building up new webpage.

What's up, its pleasant post regarding media print, we all know media is a

impressive source of facts.

Do you mind if I quote a few of your articles as long as I provide

credit and sources back to your webpage? My website is in the exact same area of interest as yours and my users would definitely

benefit from some of the information you provide here.

Please let me know if this alright with you.

Thank you!

Good post. I learn something totally new and challenging on websites I stumbleupon on a daily basis. It will always be useful to read content from other authors and use a little something from their web sites.

Do you want find other ways to get website traffic? https://smmsupreme.com

Howdy! I could have sworn I've been to this site before but after

reading through some of the post I realized it's new to me.

Nonetheless, I'm definitely happy I found it and I'll be bookmarking and checking back frequently!

Hi, I think your website might be having browser compatibility issues.

When I look at your blog in Chrome, it looks fine but when opening in Internet

Explorer, it has some overlapping. I just wanted to give you

a quick heads up! Other then that, terrific blog!

hi!,I like your writing so a lot! proportion we communicate extra approximately your

post on AOL? I require a specialist on this house to resolve my problem.

May be that is you! Looking forward to look you.

This article is truly a pleasant one it helps new net users, who

are wishing for blogging.

I am genuinely delighted to glance at this weblog posts which contains tons of useful

data, thanks for providing these kinds of information.

Hi, Neat post. There's an issue together with your website in internet explorer, would test

this? IE nonetheless is the marketplace leader and

a good component of people will miss your fantastic writing due to this problem.

Hello my friend! I wish to say that this post is awesome, great written and include approximately all significant infos.

I would like to peer extra posts like this .

I want to to thank you for this good read!! I definitely loved every little bit of it. I have got you book-marked to check out new stuff you postÖ

Well that just made my decision a whole lot easier lol.

Thanks, brotha!

Attractive component to content. I simply stumbled upon your blog and

in accession capital to say that I get in fact loved

account your blog posts. Any way I'll be subscribing to

your augment or even I achievement you get entry to constantly quickly.

Quality content is the secret to interest

the viewers to go to see the web site, that's what this site is providing.

Excellent website. Lots of useful information here. I am sending it to a few pals

ans additionally sharing in delicious. And certainly, thank you on your effort!

I think the admin of this site is genuinely working hard in support of his web

page, as here every information is quality based material.

What's up mates, how is everything, and what you

would like to say on the topic of this paragraph, in my view its genuinely awesome in favor

of me.

Hey there! I just wanted to ask if you ever have any trouble with

hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to

no back up. Do you have any solutions to prevent hackers?

Hey I know this is off topic but I was wondering if you knew of any widgets I

could add to my blog that automatically tweet my newest twitter updates.

I've been looking for a plug-in like this for

quite some time and was hoping maybe you would have some experience with something like

this. Please let me know if you run into anything. I truly enjoy reading your

blog and I look forward to your new updates.

Hello colleagues, good paragraph and fastidious arguments commented here,

I am really enjoying by these.

Thanks for sharing your thoughts on FUN88.

Regards

I'm gone to say to my little brother, that he should also pay a quick visit this web site on regular basis to

get updated from latest reports.

Appreciating the dedication you put into your blog

and in depth information you present. It's great to

come across a blog every once in a while that isn't the

same out of date rehashed information. Fantastic read!

I've bookmarked your site and I'm adding your RSS feeds to my Google account.

Thank you, I've recently been looking for info about this topic for a long time and

yours is the greatest I have found out so far.

However, what in regards to the bottom line?

Are you sure about the supply?

I really like what you guys are up too. This type of clever work

and coverage! Keep up the wonderful works guys I've added

you guys to blogroll.

I enjoy, lead to I found exactly what I was taking a look for.

You've ended my 4 day long hunt! God Bless you man. Have

a nice day. Bye

For the reason that the admin of this site

is working, no question very quickly it will be famous,

due to its feature contents.

Simply desire to say your article is as astonishing. The clearness

in your post is simply excellent and i could assume you're an expert on this subject.

Fine with your permission let me to grab your

feed to keep up to date with forthcoming post. Thanks a million and please continue the rewarding work.

Every weekend i used to visit this web site, for the reason that i wish

for enjoyment, since this this web site conations genuinely fastidious

funny data too.

Greetings! Very helpful advice in this particular article!

It's the little changes which will make the greatest changes.

Many thanks for sharing!

Amazing blog! Do you have any tips and hints for aspiring

writers? I'm planning to start my own site soon but I'm a little lost on everything.

Would you advise starting with a free platform like

Wordpress or go for a paid option? There are so many options out there that I'm totally confused ..

Any recommendations? Thank you!

Unquestionably believe that which you stated. Your favorite justification seemed to be on the net

the easiest thing to be aware of. I say to you, I definitely get

annoyed while people think about worries that they plainly don't know about.

You managed to hit the nail upon the top and defined out the whole thing without having side effect , people can take a signal.

Will likely be back to get more. Thanks

Excellent beat ! I wish to apprentice while you amend your site, how can i subscribe for a

blog web site? The account helped me a acceptable deal.

I had been a little bit acquainted of this

your broadcast offered bright clear idea

Aw, this was an incredibly nice post. Spending some time and actual effort to make a really good articleÖ but what can I sayÖ I hesitate a lot and never seem to get anything done.

This web site truly has all the information and facts I wanted concerning this subject and didnít know who to ask.

You'll be able to purchase this Fiverr clone WordPress theme on the official website for $99.

The positioning boasts a variety of professional services, so

you possibly can offer anything from copywriting and WordPress specialist to work as a

graphic designer or blogger, online fitness instructor or enterprise consultant.

With time, Fiverr work market has grown into considered one of the most important freelance websites though that is

to not say they offer the very best quality of service.

The marketplaces cost a service price of 8% to 10% of your work.

However, in contrast to other sites like Upwork, it also allows you to construct

your individual freelance design group or workforce to work on initiatives together.

It’s worth noting, nevertheless, that

the American Rescue Plan’s non permanent elimination of the "subsidy cliff" signifies that

most individuals are actually eligible for premium subsidies in the exchange, not less than through the

tip of 2022. There aren't any subsidies available for Farm

Bureau plans, so they’re actually only a gorgeous different for healthy people who

would in any other case need to pay full value for an ACA-compliant plan. Statewide, the average benchmark

plan was 5.1 % more expensive in 2016, which suggests

subsidies have been higher, however only modestly so.

Nationwide, the common charge change for 2022 amounted to an increase of about

3.5%, making the Texas price changes very a lot in line with

the nationwide average.

Hi there, You have performed a great job. I'll certainly digg it and individually suggest to

my friends. I am confident they'll be benefited from this site.

I couldn't resist commenting. Well written!

Hi there! This post could not be written any better! Reading through this post reminds me of my previous room mate!

He always kept chatting about this. I will forward this article to

him. Fairly certain he will have a good read. Thanks for sharing!

Nice post. I was checking continuously this weblog and I'm impressed!

Extremely useful information specifically the ultimate part :

) I handle such information much. I used to be seeking this particular info for a very long time.

Thank you and best of luck.

This post is in fact a fastidious one it assists new web users, who are wishing for

blogging.

I was wondering if you ever thought of changing the structure of your website?

Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better.

Youve got an awful lot of text for only having 1 or two pictures.

Maybe you could space it out better?

I know this web site offers quality depending articles or reviews and other information, is there any other web site which provides these things in quality?

For most recent news you have to visit internet and

on internet I found this site as a finest web site for most recent updates.

Howdy! This article could not be written much

better! Looking through this post reminds me of my previous roommate!

He continually kept preaching about this. I'll send this article to him.

Pretty sure he'll have a great read. Thanks for sharing!

Thanks , I've recently been looking for information approximately this subject for ages and yours is the

greatest I've discovered so far. But, what about the bottom line?

Are you positive about the supply?

Greetings from Idaho! I'm bored to death at work so I decided

tto browse your blog on my iphone during lunch break. I loe the information you provide here and can't wait to take a look when I gget home.

I'm surprised at how quick your blog loaded on my cell phone ..

I'm not even usinjg WIFI, just 3G .. Anyways, great blog!

Also visit my web site Bit.Ly

Pretty! This was an extremely wonderful post. Thanks

for supplying this info.

bookmarked!!, I like your site!

Good day! I could have sworn Iíve been to this blog before but after looking at some of the articles I realized itís new to me. Anyways, Iím certainly delighted I found it and Iíll be book-marking it and checking back frequently!

Thanks a lot for the post.Really looking forward to read more. Fantastic.

There is definately a lot to learn about this topic. I really like all of the points you made.

After looking over a handful of the blog posts on your web page, I truly appreciate your way of blogging.

I book marked it to my bookmark website list and

will be checking back soon. Please visit my website as well and tell me your opinion.

Hello mates, pleasant article and fastidious arguments commented here, I am truly enjoying by these.

Hey there! Do you use Twitter? I'd like to

follow you if that would be okay. I'm definitely enjoying your blog and look forward to new updates.

That is a really good tip especially to those fresh to the blogosphere. Simple but very accurate informationÖ Appreciate your sharing this one. A must read article!

I go to see day-to-day some web sites and sites to read content,

except this web site gives feature based content.

Hey! I could have sworn I've been to this website before but

after checking through some of thhe post I realized it's new to me.

Nonetheless, I'm definitely glad I found it and I'll be book-marking and checking back

often!

Here is my web page :: funeral programs

What's up, its pleasant post on the topic of

media print, we all be aware of media is a wonderful source of facts.

This design is wicked! You obviously know how to

keep a reader amused. Between your wit and your videos, I was almost moved to start

my own blog (well, almost...HaHa!) Excellent job.

I really loved what you had to say, and more than that, how you presented it.

Too cool!

Appreciate the recommendation. Let me try it out.

It's a shame you don't have a donate button! I'd most

certainly donate to this superb blog! I suppose for now i'll settle for bookmarking and adding your RSS feed to my Google account.

I look forward to fresh updates and will talk about this site with my Facebook group.

Talk soon!

Your method of explaining all in this piece of writing is actually fastidious, every one be capable of effortlessly understand it, Thanks a lot.

This piece of writing will assist the internet viewers for setting up new weblog or

even a weblog from start to end.

It is actually a great and helpful piece of information. I am

happy that you simply shared this helpful information with us.

Please stay us informed like this. Thanks for sharing.

This is a topic that's close to my heart... Take care!

Where are your contact details though?

I think the admin of this web site is in fact working hard for his web page, because here every

material is quality based stuff.

Howdy just wanted to give you a quick heads up and let you know a few of the images

aren't loading properly. I'm not sure why but I think its a linking issue.

I've tried it in two different browsers and both show the

same outcome.

You've made some really good points there. I checked on the web for more information about the issue and found most individuals will go along with your views on this site.

Greetings! Very useful advice in this particular post!

It is the little changes that produce the greatest changes.

Many thanks for sharing!

Hmm it seems like your site ate my first comment (it was super long) so I guess I'll

just sum it up what I had written and say, I'm thoroughly enjoying your blog.

I too am an aspiring blog blogger but I'm still

new to the whole thing. Do you have any tips and hints for

newbie blog writers? I'd certainly appreciate it.

You can go to this website for more useful freelancing tips: freevacourse.com

Wow, amazing weblog layout! How lengthy have you ever been running

a blog for? you make blogging look easy. The entire glance

of your site is wonderful, as neatly as the content!

I always used to study post in news papers but now as I am a user of web

therefore from now I am using net for articles or reviews,

thanks to web.

I am really enjoying the theme/design of your website. Do

you ever run into any web browser compatibility issues?

A small number of my blog audience have complained about my blog not working correctly in Explorer but looks great in Safari.

Do you have any tips to help fix this issue?

Link exchange is nothing else but it is simply placing the other person's

website link on your page at proper place

and other person will also do similar for you.

Hi, I do believe this is an excellent blog. I stumbledupon it 😉 I

may revisit yet again since I book-marked it.

Money and freedom is the best way to change, may

you be rich and continue to guide others.

Excellent post. I used to be checking continuously this blog and I am inspired!

Extremely helpful info specifically the remaining part :

) I deal with such information much. I used to be

seeking this certain info for a very lengthy time. Thank you

and good luck.

Having read this I thought it was very informative. I appreciate you spending some time and

effort to put this informative article together.

I once again find myself spending way too much time both reading and leaving comments.

But so what, it was still worthwhile!

Do you have a spam issue on this site; I also am a blogger, and

I was wondering your situation; many of us have developed some nice methods and

we are looking to trade techniques with other folks, please shoot me an email if interested.

Please let me know if you're looking for a writer for your weblog.

You have some really good posts and I believe I would

be a good asset. If you ever want to take

some of the load off, I'd love to write some content for your blog in exchange for a link back to mine.

Please send me an email if interested. Many thanks!

Write more, thats all I have to say. Literally, it seems as though you relied on the video

to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your weblog when you could be

giving us something informative to read?

Hello! Would you mind if I share your blog with my facebook group?

There's a lot of people that I think would really appreciate

your content. Please let me know. Cheers

Hey there! I've been reading your blog for some time now and finally got the courage to go ahead

and give you a shout out from Atascocita Tx! Just

wanted to say keep up the excellent job!

Hey! I know this is kinda off topic but I was wondering if you knew where I could find a

captcha plugin for my comment form? I'm using the same blog platform as yours and I'm having difficulty finding one?

Thanks a lot!

I'm really loving the theme/design of your weblog.

Do you ever run into any browser compatibility issues?

A number of my blog readers have complained about my blog not operating

correctly in Explorer but looks great in Safari. Do you have any advice to help fix this issue?

Great post. I am facing some of these issues as well..

Wow, amazing weblog structure! How long have you been blogging for?

you made blogging glance easy. The entire look of your website is great,

let alone the content!

Nice replies in return of this difficulty with firm arguments and telling everything on the topic of that.

Good day! This is kind of off topic but I need some advice from an established blog.

Is it very difficult to set up your own blog?

I'm not very techincal but I can figure things out pretty fast.

I'm thinking about making my own but I'm not sure where

to start. Do you have any tips or suggestions? Thanks

You can go to this website for more useful freelancing tips: freevacourse.com

I was extremely pleased to find this site. I want to to thank you for ones

time for this fantastic read!! I definitely loved every little

bit of it and i also have you book marked to

check out new information in your website.

I was wondering if you ever considered changing the

page layout of your site? Its very well written; I love what youve

got to say. But maybe you could a little more in the way of content so

people could connect with it better. Youve got an awful lot of text for only having one or two images.

Maybe you could space it out better?

After looking over a handful of the blog articles on your site,

I really like your technique of writing a blog. I saved it to my bookmark site list and will be checking back

soon. Please check out my web site as well and

tell me what you think.

Hi there! I just want to give an enormous thumbs up for the nice data you've gotten right here on this post. I shall be coming back to your blog for more soon.

Hmm is anyone else having problems with the images on this blog loading?

I'm trying to find out if its a problem on my end or if it's the blog.

Any feedback would be greatly appreciated.

Would you be inquisitive about exchanging links?

Wow, this article is nice, my younger sister is analyzing

such things, therefore I am going to convey her.

Great post. I was checking constantly this blog

and I am impressed! Extremely helpful information specially the last part 🙂

I care for such information a lot. I was seeking this certain info for a very

long time. Thank you and best of luck.

It's really a nice and helpful piece of info.

I am happy that you shared this useful information with us.

Please stay us informed like this. Thanks for sharing.

My brother suggested I would possibly like this web site. He used to be entirely right.

This submit truly made my day. You can not imagine simply how much time I had

spent for this information! Thank you!

What's up Dear, are you truly visiting this site daily, if so afterward you

will definitely get nice experience.

Informative article, totally what I was looking for.

Do you mind if I quote a couple of your posts as

long as I provide credit and sources back to your blog?

My blog site is in the very same niche as yours and my users would genuinely benefit from a lot of the information you

provide here. Please let me know if this ok with you.

Many thanks!

After research a couple of of the blog posts on your website now, and I really like your method of blogging. I bookmarked it to my bookmark web site listing and shall be checking back soon. Pls check out my web page as properly and let me know what you think.

Hey! I just wanted to ask if you ever have any trouble with hackers?

My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no back up.

Do you have any solutions to stop hackers?

Hey! I'm at work browsing your blog from my new

iphone 4! Just wanted to say I love reading through

your blog and look forward to all your posts! Carry on the outstanding

work!

I go to see daily a few web pages and information sites

to read articles or reviews, however this website offers feature

based posts.

I do agree with all of the ideas you have introduced to your

post. They're very convincing and will definitely

work. Still, the posts are too short for novices.

May just you please prolong them a bit from subsequent time?

Thanks for the post.

fantastic points altogether, you simply received a brand new reader.

What could you suggest about your submit that you made some days

ago? Any sure?

Hello to all, how is all, I think every one is getting more from this website, and your views are nice in favor of

new viewers.

Generally I don't read post on blogs, but I would like to say that this

write-up very forced me to try and do it! Your writing

style has been surprised me. Thanks, quite great post.

Its like you read my mind! You appear to know a lot

about this, like you wrote the book in it or something.

I think that you can do with some pics to drive

the message home a bit, but instead of that, this is

fantastic blog. A great read. I will definitely be back.

This is really attention-grabbing, You're a very professional blogger.

I have joined your feed and look forward to looking for more of your fantastic post.

Additionally, I've shared your site in my social networks

hi!,I love your writing very much! proportion we

keep up a correspondence more about your post on AOL?

I need a specialist on this space to solve my problem.

May be that is you! Taking a look ahead to see you.

After going over a number of the articles on your blog, I honestly appreciate your technique of writing a blog.

I saved it to my bookmark site list and will be checking back soon. Please visit my web site as

well and let me know how you feel.

I'm really enjoying the design and layout of your website.

It's a very easy on the eyes which makes it much more pleasant

for me to come here and visit more often. Did you hire out a designer to

create your theme? Great work!

Hello I am so delighted I found your weblog, I really found you by error, while I was browsing on Aol

for something else, Nonetheless I am here now and would just like to say

thank you for a marvelous post and a all round exciting blog

(I also love the theme/design), I don't have time to browse

it all at the minute but I have saved it and also

added in your RSS feeds, so when I have time I will be back to read a great deal more, Please

do keep up the excellent job.

Amazing! This blog looks just like my old one! It's on a entirely different

subject but it has pretty much the same layout and design. Excellent choice of colors!

I absolutely love your site.. Pleasant colors & theme. Did you create this web site yourself?

Please reply back as I'm attempting to create my

very own blog and would like to learn where you got this from

or just what the theme is named. Appreciate it!

Hi there, I believe your blog might be having internet browser

compatibility problems. When I look at your web site in Safari, it looks fine however, when opening in I.E., it's got some overlapping issues.

I simply wanted to provide you with a quick heads up!

Other than that, fantastic blog!

Hello,

Thank you so much for this detailed guide. I feel a little more confident now to register as freelancer (I also came from working locally employed). My question is what happens to those issued receipts to international clients? Do you have those clients receive it actually?

I have read several excellent stuff here.

Definitely price bookmarking for revisiting. I surprise how a lot effort you set

to make any such wonderful informative web site.

I have read several excellent stuff here. Certainly worth bookmarking for revisiting.

I wonder how so much effort you put to create this sort of magnificent informative website.

What's up every one, here every one is sharing these

kinds of experience, therefore it's fastidious to read this weblog, and I used to pay a quick visit this website all the

time.

Wow, awesome blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your web site is fantastic,

as well as the content!

Hi, I want to subscribe for this website to get newest updates, thus where can i do it please help out.

Everything is very open with a really clear description of the challenges.

It was really informative. Your website is extremely helpful.

Thank you for sharing!

Hello! I realize this is somewhat off-topic but I needed to ask.

Does managing a well-established website like

yours require a large amount of work? I am completely new to running a blog but I do write in my journal on a daily basis.

I'd like to start a blog so I can share my own experience and feelings online.

Please let me know if you have any kind of suggestions or

tips for brand new aspiring blog owners. Thankyou!

You can go to this website for more useful freelancing tips: freevacourse.com

I'm often to blogging and i actually admire your content. The article has actually peaks my interest. I am going to bookmark your website and keep checking for brand new information.

Thanks for sharing your thoughts about best binary options signals 2013 nissan. Regards

hi!,I like your writing very so much! share we keep in touch extra approximately your

post on AOL? I need a specialist on this space to solve my

problem. May be that's you! Taking a look forward to look you.

This website is known as a stroll-by for the entire info you needed about this and didn抰 know who to ask. Glimpse here, and also you抣l undoubtedly discover it.

Thanks for a marvelous posting! I certainly enjoyed reading it, you could be a great author.

I will make sure to bookmark your blog and will eventually come back very

soon. I want to encourage continue your great writing,

have a nice evening!

I am really delighted to read this website posts which consists of tons of helpful

data, thanks for providing these statistics.

Hi! Someone in my Facebook group shared this site with us so I came

to check it out. I'm definitely loving the information.

I'm book-marking and will be tweeting this to

my followers! Outstanding blog and amazing style and design.

If some one needs expert view about running a blog

afterward i recommend him/her to pay a visit this webpage, Keep up