Menu

Does the mere mention of the word "TAX" give you an instant headache?

Thinking about the forms and requirements can be quite overwhelming and confusing.

But there are serious drawbacks if you don't file your Income Tax Return (ITR). As a freelancer, you may not be able to apply for housing and/or car loans, tourist visas, or even credit cards since ITR is one of the usual requirements.

It feels like going to a dentist when you have a troublesome tooth. You just have to go through the pain now for the sake of long term benefits.

But did anyone ever tell you there's a pain-free way to handle taxes on your own?

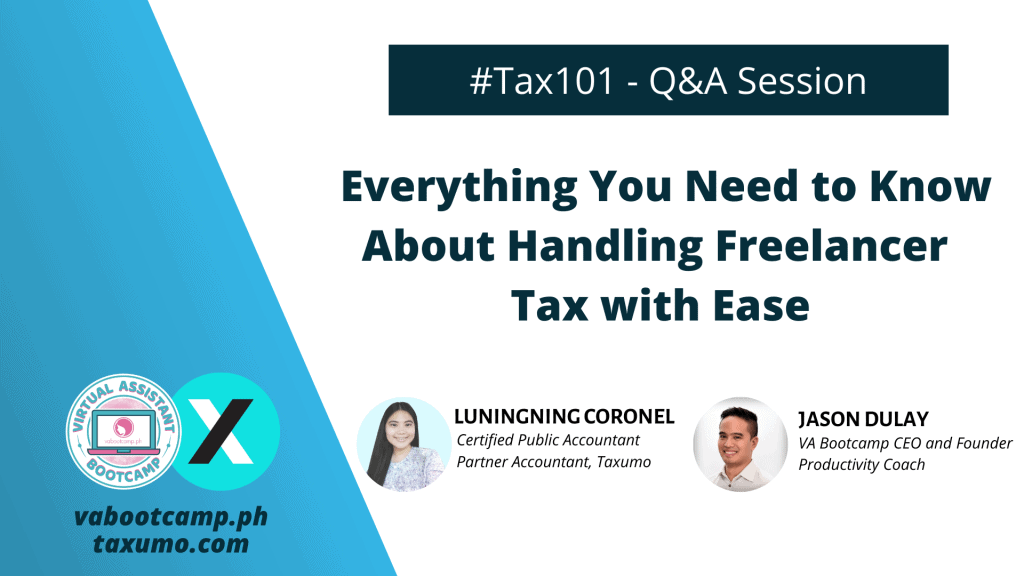

Stay tuned on our LIVE Q&A Session: Everything You Need to Know About Handling Freelancing Tax With Ease

When: July 4, 2020, at 5:00 PM.

We're inviting an expert from Taxumo - the best online tax tool that allows you to take care of your taxes literally within minutes!

Prepare your questions in advance so you can finally get them off your chest.

Ready to hang out and learn? Comment "TAX 101" below and make sure to tag your friends.

Bisa required

Score Tracker:

2 point Hazel Apuhin

1 point Dianne Gamez

Winner to si Hazel

Score Tracker:

2 point Hazel Apuhin

2 point Dianne Gamez

TIED na ang score!

Please post any questions related to business registration 🙂

currently my RDO is in Pampanga , and i need to transfer in marikina asap. can i file in marikina for the transfer? I can't go to Pampanga at the moment

I am registered as soleprop.. pero I started to hire VA’s and Wevdevs as an agency pero d cla full time. Currently I am still paying tax as soleprop. Do I need to change it to corp?

Can freelancers apply online instead of going physically to BIR offices especially its ecq here?

I am rendering my 30 day resignation on my office job and I am starting on my freelance work in Monday. What should I do?

Once registered po this July, do we need to declare our past transactions? Accoring to memo 60-2020, we are encourage to voluntary declare our past transactions subject to pertinent taxes etc... those who failed to declare past due taxes/unpaid taxes shall be impose with penalties under the law. Yun po ba ibig sabihin na from January kailngan namin ideclare un this July? Thanks po

Does any income range? Or pweding tax excepted ang i declare

i see thanks

how long usually is the transfer and the completion of the registration? My contract as a freelancer will start on July 21. if in case it will completed be on August, can i declare my income this July? Thank you.

How much is the service?

sa taxumo?

How is it if I am employed upto this month, then I will shift to freelancing the next month. My employer already filed our 2316 last february, do I need to register again as self employed for this year? What if I cant have a client and have no income?

Someone is taking care of my taxes for me now, I gave her SPO and I am paying 2k. Pero I am having prob dealing with her like getting a clear copy of my ITR. So, I am thinking of doing it myself of to get a new service. How much yung taxumo services?

Awts. Baka pala magkaroon ng conflict. I'll ask our finance officer po agad. Thank you so much!

Pano kung may existing business na tapos gusto din magparegister as a freelancer. What's the first step to take?

bat kaya aq nirequire ng mayors permit at bayad ng tax sa municipality.

Thanks for answering

When i register can i choose the 8% rate?

im planning to register my online business, and ngpplan dn ako mgfreelance, ano po dapat ko register o dpat mgkaiba pa cya?

Panu po kung kaka.resign ko palang from my office job last May , then hindi pa nila nafile yung 2316 ko , kc last year iba din employer ko, at hindi q napasa ung 2316 q from my last year employer ..

How much does BIR impose in terms of penalties? Is there a computation?

Last question po kahit hindi related sa tax. Kinabahan po ako e

Okay lang ba na maging freelancer ang isang government employee sir JD? Salamat po

What if the client contract shows that I started Feb and then august po ako nagregister? Are there any penalties po ba?

Is there a proof of income requirement for freelancers when registering in BIR?

Yep, technical na po. For mix income earner to clarify,8% ng income is your tax

sorry, I know baka na explain muna pero can you elaborate on the difference between the 8% vs 3% quarterly + 20-25% annually? saan mka less?

Hi. If i am working as a consultant and i have not filed my ITR eversince i started working. How is my penalty computed? Also can you elaborate on what forms do I need when i am about to file my first ITR. Ive been working for 3 years

I am currently under corporate employment and planning to do part time in freelancing. Do I still have to register separately my income tax from freelancing? Or let my employer know about it.

+

How do they monitor it? I mean,, what if someone will file na zero, pero may income naman pala?

Another question is, what if you have multiple businesses with different names? Paano or ano ang process ng registration?

Wow. Thanks for answering.

Oderfla Becoy Paghasian Jr.

hahahaha ..yes!

Thank you mam mutya

Thank you maam

Thank you po. God bless!

Thank you.

Thank you for sharing your knowledge.

thank you

yearly?

is that a yearly rate?

nice 🙂

yey 50% discount

hahaha

discount

Nice!

Thanks

Thank you! I hope I was able to bring more clarification rather than more confusion.

From Pasay city, im learning to be a freelancer and its legality..

Helen from paranaque

Hello From Manila.

Tax penalties

Watching from Lumina San Pablo Laguna

Davao City

Hello sir.. from Cebu

First time

From .qc

Claire Martinez