Menu

Updated as of January 2020. The process detailed in this blog post is still applicable for the current year.

The first quarter of 2019 has ended and if you're a BIR-registered freelancer, you are required by law to file your Quarterly Income Tax Return (ITR) - like me.

Luckily I finished the registration process at the beginning of this year and opted into the 8% Income Tax Rate by the TRAIN Law. You can read my detailed BIR registration process here.

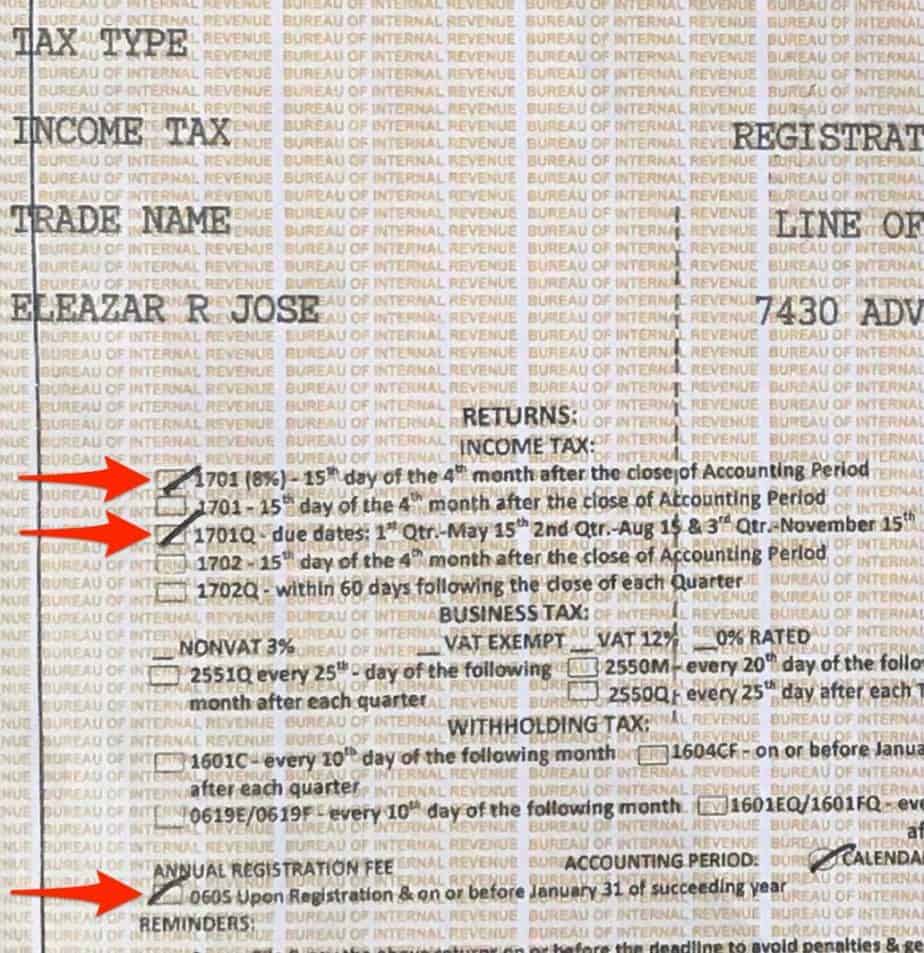

Because of this, I am only required to file and do these 3 things every year according to my Certificate of Registration (COR):

Since I only registered this year, the first thing I need to do is file my 1st Quarter's ITR.

Now, this blog post covers only a portion of the topic on Tax Calculation and Filing and focuses more on the new tax rate by the TRAIN Law which is the 8%.

Anything beyond that, you'll have to do your own research first.

Why? Because that's what I opted in for and as someone who is NOT an accountant or a tax expert, I can only provide our readers what I know and have researched.

I can definitely share the process and my experience on how simple it was to file my Quarterly ITR from home because of the following:

Before we dive deep into the process of filing your taxes from home, let me quickly insert and teach you how to fill out your journal of transactions in the simplest method. This is part of your books of accounts as someone who's running a freelancing business.

In my case of the 8% tax rate, I don't have to declare expenses because I can't claim them as deductions in my income to compute my tax dues.

Ok, that's good. Keeping things really simple here and that was fine with me because I don't like keeping receipts. What I do is every time money comes out of my pocket or bank account for cash transactions, I record them in an Expense Manager & Budget Planner app called Money Lover.

So going back, it's very easy to record cash and income transactions with the debit and credit system known as double-entry bookkeeping. We'll only discuss the basics of it related to us, freelancers.

Example: You're a freelancer who performed a service to a client and was paid P30,000 for the month of January.

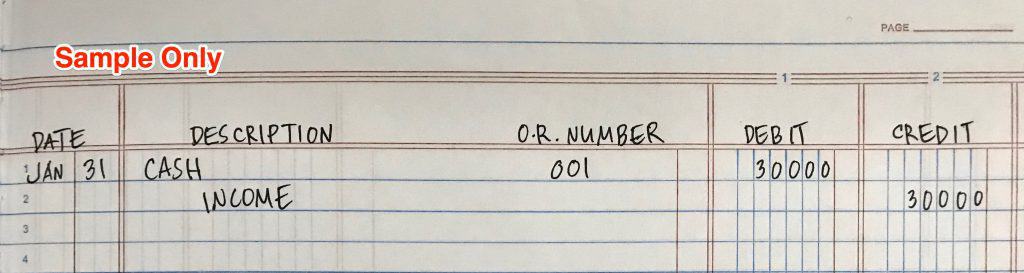

Here's how you will record that. In your Journal you have 5 columns as shown in the image below.

For the CASH row under the DEBIT column, you'll put 30,000. This is a debit transaction meaning a decrease

Explanation: The payment you received from your client is good as cash right? Whether it's through PayPal, local funds transfer, etc. it will somehow land in your bank account (or hands) as cash.

Now imagine, you have a jar at home that has a label called CASH. That CASH is categorized as your asset. So in the accounting world, to add to an asset, you have to debit it and that's just how it works.

Maybe your mind is thinking right now, shouldn't it be an increase instead of a decrease since I got paid by my client? So therefore my cash in my bank account or cash on hand should also increase right?

A bit confusing at first but I got the point. To add to an asset (in this case CASH), you have to debit it. Remember that rule.

Explanation: This one is easy and it is just the recording of how much income you've made. That's it.

Repeat the process for February, March and so on.

To minimize the number of journal entries and avoid all the confusion, I sum up my freelancing income for the month and then record the entries.

For the next step, you have to know how much was your total income in the first quarter of 2019.

Let's have Example 1:

January - P30,000

February - P32,000

March - P34,000

Total income for Q1 - P96,000

From there, if you registered for the 8% tax rate, you have a P250,000 per year personal tax exemption.

This means that you will only pay for taxes if your total yearly income exceeds P250,000.

So to compute your Q1 tax dues, it will be like this.

Total Q1 income minus P250K Tax Exemption multiplied by 8%

P96,000 - P250,000 = You will come up with a negative P154,000.

Multiple that by 8% and you will come up with 0.00

This means that your Q1 tax due is P0.00 and you still have a remaining tax exemption of P154,000 for the rest of the year.

Easy, right?

Let's have Example 2:

January - P75,000

February - P85,000

March - P95,000Total income for Q1 - P255,000

For Q1 alone, you have exceeded your P250K tax exemption for the year.

Now to compute your Q1 tax dues, it will be like this.

Total Q1 income - P250K Tax Exemption multiplied by 8%

P255,000 - P250,000 = P5,000

Multiple that by 8% and you will get P400.00

This means that your Q1 tax due is P400.00 and you have already used up the entire P250,000 tax exemption for the year.

Again, easy right?

Armed with this information, how do you now file your Quarterly ITR (form 1701Q) from home for free?

I've spent time researching different 3rd party providers for this specific service and came up with JuanTax - a tax filing solution that is free to use.

So I signed up to it via their website juan.tax. It's completely free to sign up as it says so on their website's home page.

I actually embedded a slideshow presentation tutorial the first time I published this blog post but sad to say it was accidentally deleted. The presentation showed step by step on how to sign up for JuanTax and navigate their platform so you can file your Q1 Income Tax Return successfully.

Instead, you can watch my Facebook video tutorial below on how I filed my 2019 Q3 Income Tax Return.

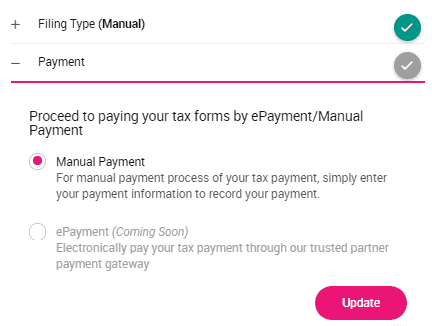

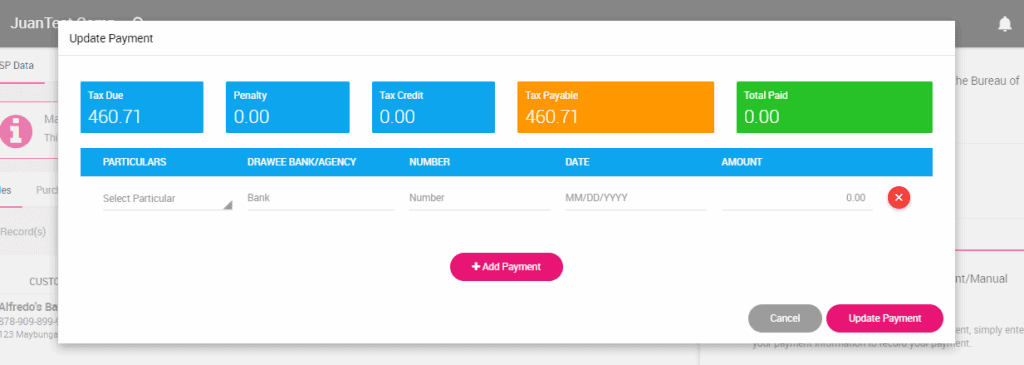

After you have completed filing your Quarterly ITR via JuanTax, you're basically done in filing your Quarterly ITR.

If you have a tax due for Q1, you can pay online outside of JuanTax using the following methods:

Pay via Credit or Debit Cards using DBP's portal:

Using GCash:

(From the JuanTax Help Center)

If you're a freelancer earning around P30,000 monthly, you'll pay around P8,800 for income taxes a year, and the yearly P500 registration fee.

That sounds pretty good and fair compared to the hefty amount traditional employees are being deducted for taxes who are earning the same amount.

That's why I chose the TRAIN Law's 8% Income Tax rate because it simplifies my relationship with taxes and BIR.

And that's it for the Filing of the Quarterly Income Tax Return for Q1. Whew! I hope you find this helpful, guys in your freelancing businesses.

Do share this on your Facebook profile (or groups) for the benefit of your freelancer, professional, and business owner friends!

See you around the online and offline spaces. If you have any questions about this blog post, feel free to comment below or contact me on Facebook.

Very well said, Eleazar. This is a helpful to everyone of us and most specially to those who are still afraid to file their Taxes.

Thanks for the feedback Rodney. Glad you found this helpful. Hope that more people will not be afraid anymore to file their taxes because there's no reason they should be. BIR is aware of the current online freelancing industry and we at the VA Bootcamp, encourage everyone to do the right thing. But of course, it is still one's choice.

Hi, I'm just curious. So what happen if you are only earning less than 20k a month? Does that mean na wala kang babayaran na tax aside from the yearly registration fee? I hope to get enlightened. Thank you

As long as less than 250,000.00 per year ang earnings mo, ang tax due mo is 0 so wala ka talagang babayaran. You just have to make sure to file pa din para nasa record ng BIR. Otherwise, magkakapenalty fee ka for not filing. Whether with or without tax due, still required to file pag registered ka.

Thank you so much. I have been wanting to register as freelancer but doubtful kasi I have very little knowledge when it comes to taxes. Thanks for this article. I might visit BIR next week 🙂

You're welcome 🙂

Hi Eleazar! So glad, I found your blog. This is very helpful especially for first-time taxpayer like me. I just want to confirm, because you opted for 8% tax, you are only keeping/maintaining 1 Journal? I received 2 Journals kasi, is the 2nd one just an extra? Thanks in advance.

Good to hear that Jovilyn! I only keep/maintain 1 Journal. For the 2nd one you received, I don't know what it's for but to make things simple in my business and my records, I only have 1 Journal.

Hi Sir LJ! Thank you for this super informative post! I'm about to register as a freelancer myself next week and your articles really helped me. I have some questions that are still confusing me though hehe. Please bear with me as these things still confuse me.

1, For the 8% income tax option, am I the one who chooses that or the authorities?

2. If I don't exceed the P250k quarterly does this mean I don't have to do anything since I don't really have to pay?

3. For example, I earned P126,000 for Q1, so I don't have to pay for taxes, right. For Q2 I earned the same amount, P126,000. Should I add the income from Q1 and Q2? Because if I do, It will P252,00 and I would already have exceeded the P250k exemption.

Again, thanks so much Sir LJ!

Hello Gel, you're welcome!

1. You will be the one to choose that. You have to explicitly tell the assessing officer that you want the 8%. When I handed in my docs for evaluation, I immediately told the officer, I want the 8%. Para ma note na nila agad.

2. You still have to file even if you don't exceed and have no tax dues. Otherwise, you will be penalized with a fee for late filing or not filing at all because you're already registered.

3. Yes that's right. It's compounded and when the time comes to file again, then you will calculate how much is the total you've earned for the year and how much you've exceeded from the exemption and how much you will have to pay for tax due as a result of that.

Hi Eleazar,

Pag juan tax gamit mo kelangan pa ba mag upload ng receipt? Hindi naman ako nag iisue ng receipt sa US based na client ko,

After going over a handful of the blog articles on your website, I seriously like

your technique of blogging. I bookmarked it to my bookmark webpage list and will be checking back soon. Please visit my website too and let me know what you

think.