Menu

You hesitated to leave the corporate world because of “the benefits.”

For most, this pertains to healthcare.

But now that you’ve joined the freelancing world, you wonder:

“Should I still get healthcare now?”

Well, none of us is getting younger. And no one can really predict when illnesses or emergencies come (nor can we stop them).

So, the short answer? Yes, you should still get healthcare.

Which one? Now, that calls for a longer discussion.

We often hear these terms when talking about healthcare, interchanging them sometimes, but what’s the difference between the three?

Philhealth is our national health insurance provider. It is owned by the government, so it’s affordable and accessible to all. Membership has no age limits and senior citizens are automatically covered.

As freelancers, we fall under Philhealth’s Informal Economy Category or self-earning, individually paying members.

According to their website, “individually Paying Members with an average monthly income of P25,000 and below, pay P200 monthly or P2,400 per year.”

“While those earning higher should pay P300 monthly or P3,600 per year. Premium contributions may be paid monthly, quarterly, semi-annually or annually.”

I recommend just paying annually to avoid multiple trips to pay or having to remember due dates.

Being government-owned does NOT mean that you can only use Philhealth in public hospitals, accredited private hospitals accept them, too.

As for coverage, they offer case rates instead of annual coverage limits.

For example, dengue fever has a case rate of P10,000 (as of 2017), so this amount gets deducted from the total hospital bill.

Depending on the case, though, Philhealth coverage might only be a small percentage of your total bill - that’s why it’s advisable to use it with a secondary health insurance.

For more Philhealth benefits, check: https://www.philhealth.gov.ph/benefits/

That healthcare benefit you’ve had as an employee? That’s from an HMO.

HMOs are private healthcare providers. They’re mostly non-life insurance, so they’re great for immediate needs like consultations, inpatient/outpatient care, surgeries, and laboratory tests.

Popular HMO companies are Maxicare, Valucare, Intellicare, Asianlife, etc.

Say, one day, you woke up with a fever. You were about to go for breakfast, but you’ve lost your appetite and there’s a throbbing pain in your throat when you swallow.

You’d rather stay in bed the entire day. But as a responsible adult, you know that you must see a doctor before you get any worse.

If you have an HMO card, you can just go to any doctor or clinics within the HMO’s accredited network to get check-ups and tests – without paying anything out of your pocket.

Most businesses and their employees get HMO’s because the more people avail, the cheaper the premium.

This may be the reason why it’s trickier for freelancers to get one. We can still buy individual plans but for a higher price.

Most plans are customizable, you can choose packages to include or exclude maternity, optical or dental coverage. But take note that HMO plans often have age restrictions and annual coverage limits.

Of course, the more expensive the plan is, the better the coverage.

To check different HMO plans, this site looks interesting: https://mariahealth.ph/individual

(Disclaimer: I haven’t personally used MariaHealth and I’m also not an affiliate. I just found them while doing research and thought that their HMO partners and prepaid health cards might be helpful for freelancers.)

Primarily, health insurance plans provide reimbursement to policy owners for medical, surgical, and critical illness expenses.

Often tied up with life insurance, you can receive cash payouts in case of critical illnesses or loss of income due to accidents and emergencies. In case of sudden death, your beneficiaries will also receive cash assistance.

Health insurance plans are great investments for income protection.

Popular health insurance companies are AXA, Sun Life, Pru Life UK, Philam Life, etc.

While it’s not ideal for immediate needs like HMOs, some policies cover consultations during hospitalization. Some special plans also allow for cashless transactions.

Unlike HMOs, health insurance is often offered to individual payers. Their premiums may be higher, but they also give higher coverage and wider terms.

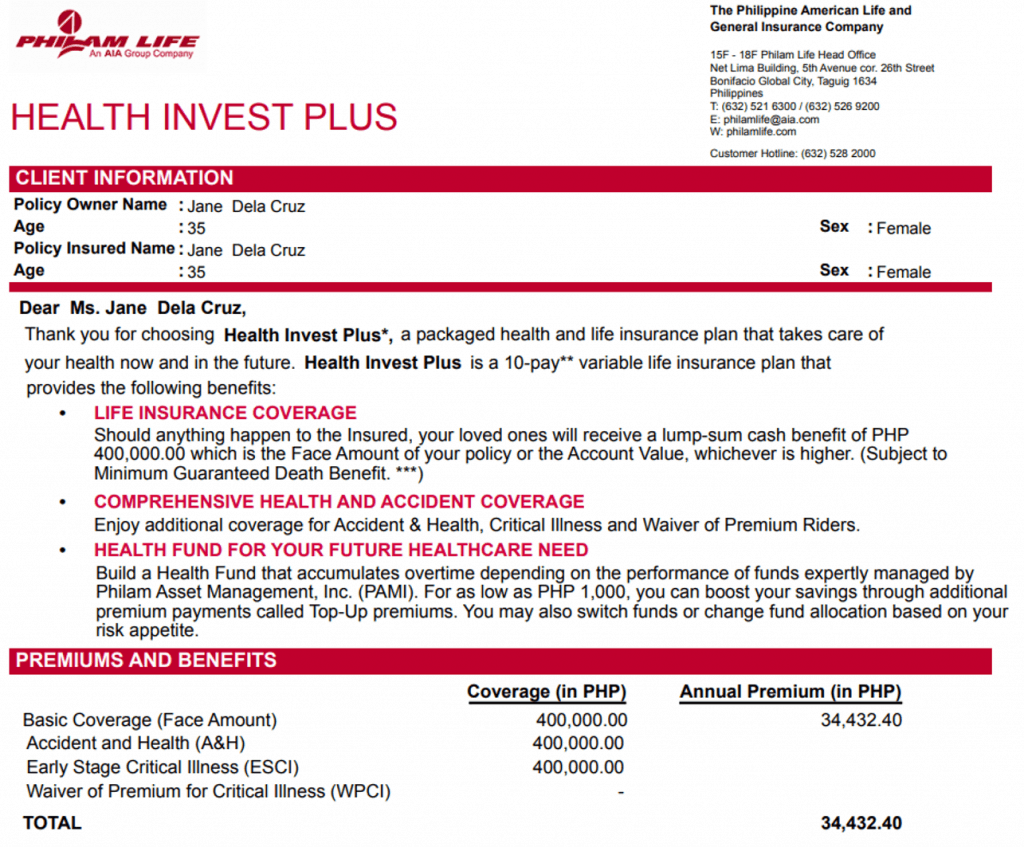

Here's a sample policy from Philam Life:

For questions, contact JC Santos at 09175321126 or email him: [email protected]. Just mention that you found him through Jason Dulay 😉

Premiums can be paid monthly, quarterly, or annually for a fixed term. And you can get medical coverage until past the retirement age.

For digital nomads, you can also find plans with international coverage. This is a great deal ‘coz medicals are very expensive abroad.

Well, 3 things you should ask yourself:

1. What is your budget?

How much are you willing to set aside for healthcare?

At the very minimum, I’d say spare P2,400/year to get Philhealth coverage.

If you still have extra, budget around P15,000+/head/year for multi-use HMO cards or about P35,000+/year for health insurance. Remember that different plans have different prices and inclusions.

2. How is your current health (or your dependents’)?

If you’re prone to illnesses or often find yourself (or your dependents) consulting a doctor or needing medical assistance, an HMO card will be more convenient and cost-effective.

But if you rarely get sick and don’t mind a reimbursement type of coverage during health emergencies, saving for a health insurance might serve you better long-term.

3. Are there accredited networks near you?

Don’t wait for sickness or emergencies to answer this.

Check which hospitals, clinics, or doctors near you accept Philhealth or the health insurance you intend to get.

If you’re torn between companies, compare how many of their accredited clinics & doctors are accessible to you, along with their annual coverage limits and premiums.

Last year, I got a prepaid card from AsianLife. It was a Consultation Only card for P1500.

I used it a couple of times for consultation and had to pay out-of-the-pocket for laboratories. Thankfully, I only needed it three times last year.

My girlfriend, on the other hand, bought 2 full HMO cards for herself and for her dad. It cost them P25,000 total (with P100,000 coverage limit each). Thankfully, they also only used it for a couple of consultations.

This year, we decided not to renew and explore other options.

Her dad just finished his annual check-up without an HMO card. They paid P3500 out of the pocket.

We got a health insurance with AXA instead.

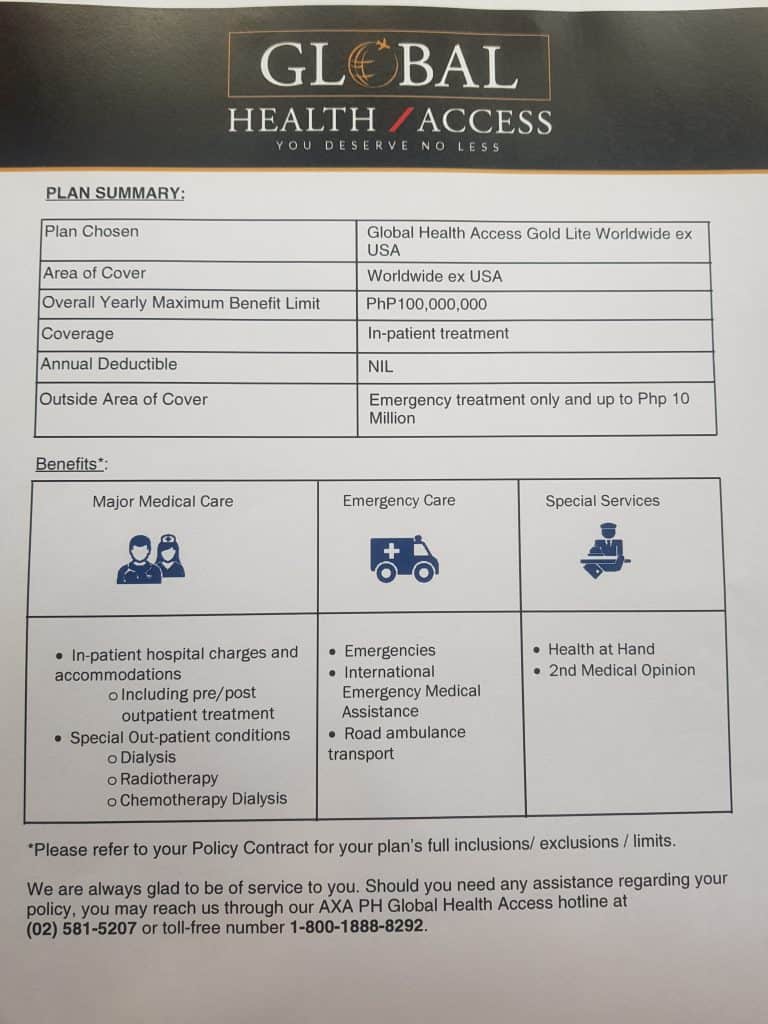

AXA’s Global Health Card has a steep annual premium of P48,000 but since we travel a lot, its international coverage is a great deal. It also includes an In-Patient Executive Check-up, that we must book in advance (which we don’t mind).

Here's how our policy looks like:

For questions, please contact Mike Campos at +639335832624 or [email protected]. Just mention that you know Jason Dulay 🙂

We strive to live healthily anyways so we hope we won’t need outpatient consultations this year. If ever, we’ll just pay P500 per consultation and some extra for lab fees.

This is just us, though. Your situation might be different.

Also, our decision might change again next year, and I’ll let you know if that happens. ?

For freelancers, I’d say everyone should get Philhealth because it’s affordable.

But between HMO and health insurance, it really boils down to what works best for you and your dependents.

If you prefer preparing for consultations and other immediate needs, get an HMO card.

If you’ve got enough savings and don’t mind getting reimbursed for medical expenses, in exchange for some future cash benefits, then a health insurance is good.

If you can afford to get both, then all the better.

Paying for healthcare may be expensive, but it’s something that's very useful to have (even though I hope that we would never need to use it).

Stay healthy everyone!