Menu

For this assignment, you’ll need to create a QuickBooks Online free trial account here: https://quickbooks.intuit.com/signup/core/?bc=USP-T92&var=y When asked for a US phone number, type: (571)3081234.

Let’s start:

Lib’s Cleaning Company is owned and managed by Libs Cleane. The business is organized as a sole proprietorship.

You are the accounting clerk for the business – your job is to create a business in QuickBooks, enter the transactions for the current month (this year), and print out three reports.

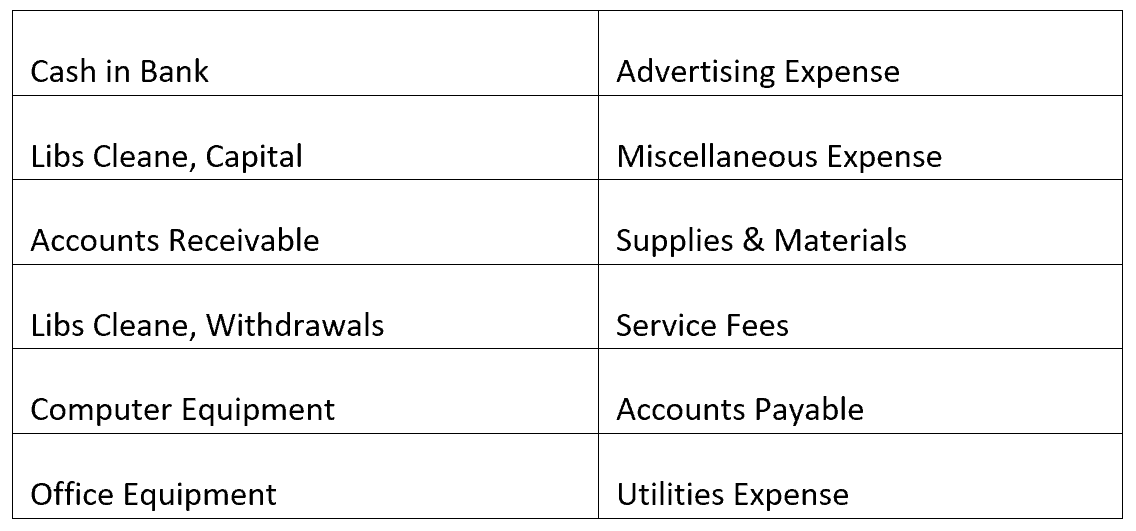

a. Make sure that the chart of accounts in QB matches these. Delete or edit, as necessary.

b. Edit the Sales account to change its name to Service Fees.

c. Add its Bank Account in the chart of accounts. Name the account, Cash in Bank.

d. Close the Chart of Accounts

Lib’s Cleaning Company sells services only. It offers commercial cleaning and residential cleaning.

For corporate buildings, it provides carpet shampooing for $100 and general cleaning services for $500. For houses and condos, it offers general cleaning services for $150.

All prices may vary depending on the floor area.

Company Transactions by Date

(The sample transactions are in June, but please use the previous month of the current date.

Example: If you're doing this assignment on February 2018, please use January 1 instead of June 1 for your dates.)

June 1 Libs Cleane, the owner, invested $10,000 cash in the business. (Record Deposits)

June 4 The business purchased $400 worth of computer equipment from Express Computers, writing a check. (Write Checks – remember, it’s an item, call it a Computer (a fixed asset))

June 5 The business purchased $300 of window wipers on account from Commercial Soapies, Inc. (Enter Bills – it’s an item, call it a Wiper)

June 7 The business received and deposited $650 cash received from its client Anne Bell (condo cleaning). (Create Sales Receipt – item is Services – a service related to the Service Fees account – don’t forget to Record Deposit) Just make something up for Anne’s email address.

June 10 The business paid $250 to Statio Ads Company for advertising, and paid by check. (Write Checks – it’s an expense)

June 13 The business provided $1,200 worth of services to Moon Towers (building cleaning) on account. (Invoices)

June 17 The business paid Commercial Soapies, Inc. $100 of the money owed to them, paying by check. (Pay Bills)

June 22 The owner removed $650 from the business for personal use; the business paid this money by check. (Write Checks – expense associated with the Withdrawals account)

June 27 The business received a check from Moon Towers the $1,200 owed to it and deposited that money in the bank. (Receive Payments – don’t forget to Record Deposit)

June 29 The business wrote a check to Veralco Company for $200 to pay the electric bill for the month. (Write Checks – it’s an expense)

9. Reconcile the bank statement for the month:

a. The statement date is 6/30/--

b.The ending balance is $9,892.00

c. The bank’s service charge is $8.00

d. The following checks are outstanding:

e. A deposit for $1,200.00 made on June 27 does not appear on the statement.

Note: The difference between the Statement Ending Balance and the Cleared Balance MUST be zero.